Tax Loss Harvesting: How to Benefit From Your Losses

Tax Loss Harvesting: How to Benefit From Your Losses

Sell my losses!!! What???

Yes, you read it correctly. This is actually a strategy that a good advisor uses at the end of the year. The strategy is called “tax loss harvesting”.

Let’s talk about gains

Throughout the year, your investments will be kicking out investment gains. These gains accumulate and are taxable to you the year you earn them. While we can control the amount of capital gains from our stocks and other investments through selective selling; we can’t control how much in capital gains distributions a mutual fund will pay or when they will pay them. Many times these are paid at the tail end of December. So while large capital gain distributions might look nice, if we are not diligently watching this, it could lead to an unpleasant surprise come tax time!

This is where Caissa’s management comes into play. We keep an eye on our clients’ income and capital gains throughout the year, but we spend the majority of the month of December tracking this. At the very end of December (literally the 31st most years) we try to offset the taxable gains for our clients, helping to mitigate their tax bill come April!

How tax loss harvesting works?

Tax loss harvesting actually makes having some losses in the portfolio a valuable thing! How do we do this?

We sell investments that have losses.

You might be asking yourself, “Why would we sell an investment at a loss??? That’s crazy?” But, this is a strategy that has a dual benefit for you: It offsets your gains to reduce this year’s tax bill AND it allows you to stay in the market to reap the upside!!!

First, we “realize the loss” or sell the investment at a loss, to offset your gains. Then, we immediately reinvest the proceeds in another investment that is very similar to the one we sold. We are never out of the market, we just swap one investment for another. Next, we wait 31 days. This is the amount of time the IRS deems is long enough (they don’t let us sell it and immediately buy it back or we’d be selling every single day the market was down). After 31 days, we sell the swapped investment and buy our original investment back.

Voila, your portfolio is back to normal and we just saved you a bunch of tax!!!

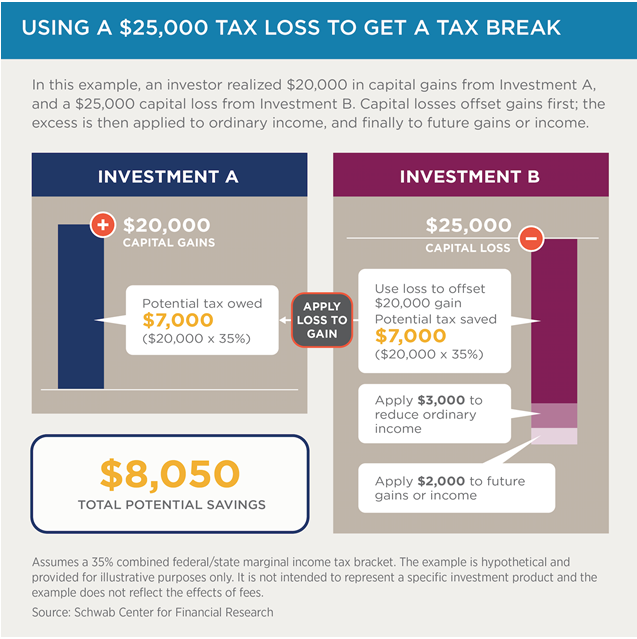

For those of you that are more visual, here is an example and summary of how this works:

If you’d like more details on the intricacy of this, please take a look at Schwab’s article http://www.schwab.com/insights/taxes/reap-benefits-tax-loss-harvesting-to-lower-your-tax-bill.

Author: Kelly Pedersen

Caissa Wealth Strategies is a fee based registered investment advisory firm, specializing in personal, dynamic wealth management. Based in Bloomington, Minnesota, Caissa financial planning professionals provide individualized strategies for every client. You can expect more from CAISSA, and in turn, you will get a fiercely loyal advocate on your side. For more news and information on wealth management solutions, visit Caissa Wealth.