June 2025: Senate Tax Bill Update

From Capitol Hill to Your Portfolio: Understanding the Latest Tax Proposals

-

- In May, the House finalized a bill focused on federal spending and tax provisions that extends key sections of the Tax Cuts & Jobs Act (TCJA), with modifications and a few new twists. The conversation continues in the Senate as the bill progresses through the legislative process. Last week, the Senate’s version of the bill was announced, and it is fairly similar to the House’s proposal, but there are differences that will be key to negotiations. Highlights include:

Key Extensions & Modifications

-

-

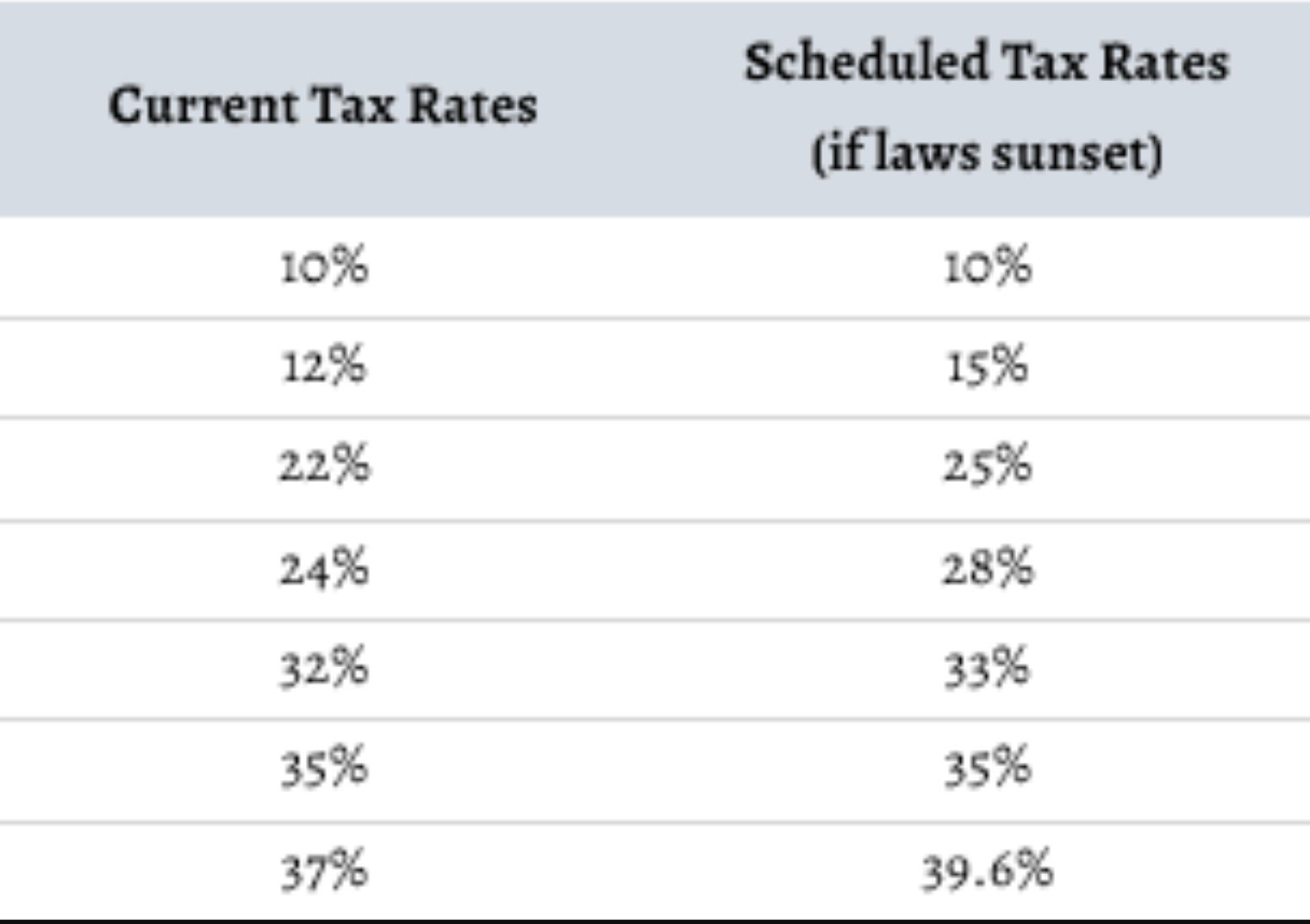

- The current ordinary income tax brackets and corresponding rates are to continue and become permanent.

- The current enhanced standard deduction will remain with modifications. The House has proposed a temporary boost for 2025-2028: $1,000 for single filers and $2,000 for married filing jointly. Taxpayers aged 65 and older receive a temporary bonus deduction for 2025-2028, subject to income phase-out. The Senate proposes a $6,000 bonus deduction, while the House proposes $4,000.

- State and local taxes (SALT) cap of $10,000 continues to be a highly debated topic. The House’s version increases the cap to $40,000 in 2025, with a phase-out at higher income levels. The Senate suggests keeping the current $10,000 cap, regardless of filing status and income. Both propose eliminating the Pass-Through Entity Tax (PTET) workaround for business owners.

- For taxpayers in the 37% tax bracket, a reduction of 2/37ths to deductions will be applied, capping total itemized deductions at 35%.

- For business owners, the future of Sec. 199A Qualified Business Income (QBI) deduction is more favorable in the House’s version providing an increase from 20% to 23%. The Senate’s proposal states the deduction is to stay at 20%.

- The House’s version of the child tax credit provides a temporary boost to $2,500 for 2025-2028, then adjusting back to $2,000 in 2029, indexed for inflation. The refundable credit amount stays the same at $1,700 in 2025. The Senate’s proposal makes the $2,000 credit permanent and refundable up to $1,400, adjusted for inflation. (After the inflation adjustment, the proposed 2025 credit would be $2,200.)

- Clean energy credits are set to expire on 12/31/2032, but the proposals aims to accelerate sunset to 12/31/2025, potentially moving up the timeline for taxpayers to complete qualifying clean energy expenses.

- Estate and lifetime gift exclusion amounts are proposed to continue at the elevated amounts, inflation-adjusted annually (2026: $15 million).

- The current ordinary income tax brackets and corresponding rates are to continue and become permanent.

-

New Provisions

-

-

- Tips and overtime pay taxation are on the table to be eliminated or reduced, aligning with the President’s priorities. The House proposes eliminating taxes on tips and overtime pay, with deductions available for 2025-2028. The Senate suggests a deduction of up to $25,000 for tip income, phased out at higher income levels, and a deduction for overtime pay capped at $12,500 for individual filers and $25,000 for joint filers.

- Both the House and Senate propose a deduction for interest on automobile loans up to $10,000 for vehicles assembled in the U.S. This deduction is available for both non-itemized and itemized tax filers from 2025-2028, subject to income phase-out. The Senate limits this deduction to new autos, while the House includes all-terrain vehicles, trailers, and campers.

- Eligible qualified expenses from a Sec. 529 plan account are expanded to include additional K-12 expenses beyond tuition. Moreover, the costs associated with obtaining post-secondary certifications and credentials are considered qualified expenses.

- Health Savings Accounts are a focus for the House’s version but were specifically excluded in the Senate’s proposal. The House’s version included higher contribution limits with a phase-out at higher income levels. It also includes making health expenses like fitness clubs, sports, and classes eligible for account reimbursement.

- The proposed “Trump Accounts” savings program allows U.S. citizens to contribute up to $5,000 annually until age 18, with tax-deferred growth. Funds can be used for education, training, small business loans, or first-time home purchases from age 18 to 29. At age 30, full access to the account is available and the account is assumed to be fully distributed and taxable at age 31. A one-time $1,000 deposit by the government for U.S. citizens born from 2025 to 2028.

-

As you contemplate how the changing federal tax landscape may impact you, please know that your CAISSA team is available to discuss further and partner with your tax and legal advisors to navigate the ever-changing tax landscape.