Bonds Are Back: Higher Yields Revive the 60/40 Portfolio

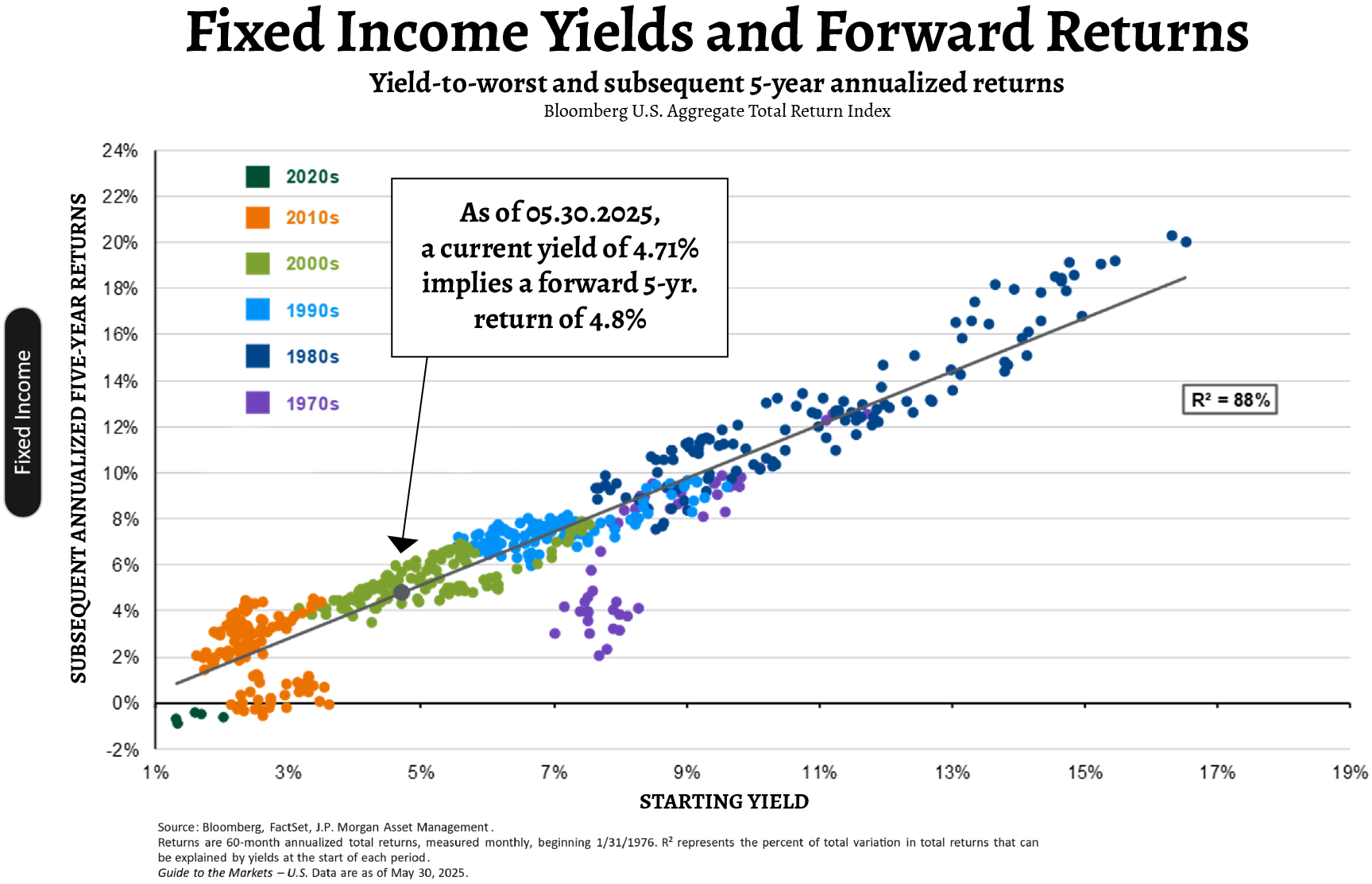

In the latest JP Morgan Guide to the Markets, the following chart illustrated what many investors have been hoping to hear: bonds are finally working again. After a turbulent period for bonds (as rates have risen over the past few years) and after more than a decade of historic low interest rates, fixed income is reclaiming its rightful place in balanced portfolios.

The data shows a compelling inverse relationship between starting yields and future returns. During the low-rate period, investors navigated an environment with minimal income and maximum interest rate risk. As the chart outlines, the R2 figure of 68% means that starting yields explain roughly two-thirds of future bond performance. Therefore, higher starting yields today set up investors for significantly better return potential than we’ve seen over the past decade, and investors’ bond allocation can now contribute steady cash flow instead of serving as expensive portfolio insurance.

The most recent narrative has been that the 60/40 portfolio was dead, which had merit during an unprecedented low-interest rate environment. With current yields near 5%, both equity and fixed income allocations can now meaningfully contribute to portfolio returns and provide greater diversification, as higher rates decreases bonds’ correlation with equities.

With starting yields near 5%, bonds can now provide meaningful returns and real diversification.

The investment landscape has fundamentally changed. Bonds now offer something that they couldn’t for over a decade: the possibility of meaningful returns alongside portfolio stability and a shift back to balanced investing principles that have served investors well for generations.