CAISSA’s July Perspectives

Each month, CAISSA performs an analysis of prevailing global events, assessing their potential influence on our clients’ wealth plan. We are diligently having strategic discussions with our portfolio managers, ensuring that our position remains informed and aligned with current market dynamics.

Below, you will find CAISSA’s perspective on key topics markets are currently digesting.

Impact of the ‘Big Beautiful Bill’ on Investment Strategies

The ‘Big Beautiful Bill’ has been signed into law, delivering on key campaign promises through a comprehensive package of permanent and temporary tax cuts and business incentives. The legislation’s primary agenda item was making permanent the 2017 Tax Cuts and Jobs Act provisions that were set to expire at the end of the year. While the bill made very few modifications to the original 2017 cuts, congressional inaction would have resulted in tax increases for over 60% American taxpayers beginning next year.

These provisions are likely to support near-term bullish sentiment in equity markets. However, this fiscal expansion comes with a price tag…

CAISSA Perspective: As proposed, the U.S. will be expanding its deficit in a non-recessionary environment. Typically, the government tends to spend more in recessionary periods to offset lower consumer spending and cushion the blow. The opposite should hold true in periods where markets are growing. With interest expense over 3% of GDP and no recession in sight, this combination is historically rare. While the bill’s passage likely prevented a recessionary tax increase on individual taxpayers and includes several pro-growth business tax cuts, the long-term risks tied to rising debt and inflation cannot be dismissed. Bond markets have already reacted to this tension with heightened volatility and an upward pressure on interest rates. Given these dynamics, maintaining an active and diversified bond portfolio is prudent to help manage risk and capture opportunities as debt levels continue to rise and reshape fixed income markets.

Continued Tariff Volatility & Political Risk

The U.S. administration has proposed raising tariffs on Canadian Imports from 25% to 35% effective August 1st, targeting goods not covered under the USMCA, such as steel, autos, and aluminum. These tariff threats have added to market uncertainty, with the U.S. citing Canada’s approach to border enforcement and fentanyl trafficking as a key concern. So far, Canada has chosen not to escalate, keeping its current 25% tariff levels in place while negotiations continue.

CAISSA Perspective: If implemented, the higher tariffs may prompt Canada to redirect trade relationships, while U.S consumers and businesses could face rising prices and renewed supply chain pressures. There will likely be little impact to the U.S. or Canadian economies if resolved this summer, but we continue to monitor all tariff developments closely as part of our broader market outlook.

When Uncertainty is High, Context is Grounding

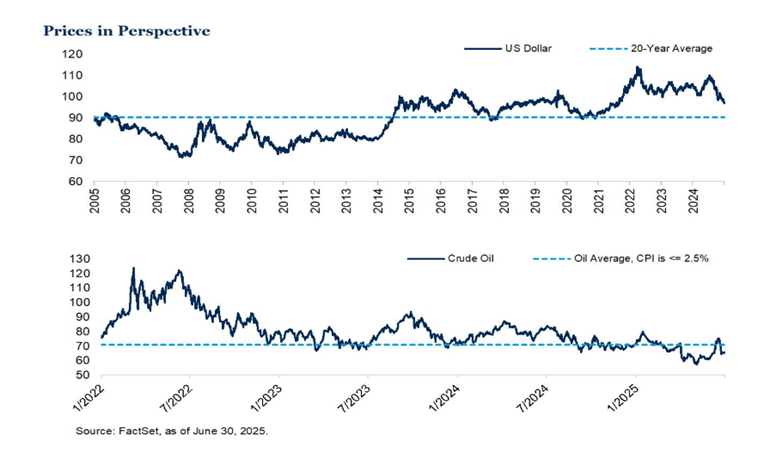

There has been discussion recently about the U.S. dollar weakening and grumblings of the potential for the U.S. losing its reserve currency status (a topic for another day). Similarly, with rising tensions in the Middle East, oil has moved up over the past month adding to inflation concerns. At first glance investors may have concerns, but with a bit of context those concerns may abate.

CAISSA Perspective: If we were to rephrase “U.S. dollar weakens -11% year-to-date“ to “U.S. dollar retraces back to 2022 levels, remains over 7% above the 20-year average“ it may elicit different levels of concern. Or, if we mention that oil is below average historical levels when inflation was around 2.5%, that may also elicit different levels of concern. Context matters.