CAISSA’s August Perspectives

Each month, CAISSA performs an analysis of prevailing global events, assessing their potential influence on our clients’ wealth plan. We are diligently having strategic discussions with our portfolio managers, ensuring that our position remains informed and aligned with current market dynamics.

Below, you will find CAISSA’s perspective on key topics markets are currently digesting.

Labor Market Cooling, But Not Cracking

In July, the U.S. economy added 73,000 jobs, well below expectations, while job gains from May and June were significantly revised downward. The unemployment rate ticked up slightly to 4.2%, signaling a gradual cooling in the labor market.

CAISSA Perspective: These developments suggest the labor market is losing momentum. However, it remains relatively balanced. Hiring has slowed in line with softer economic demand, but the supply of workers has also moderated, partly due to reduced immigration and slower population growth. With demographic trends shifting, the economy may not need to generate jobs at the same pace as in prior expansion cycles to maintain stability.

We continue to watch these trends closely. A resilient labor market is essential to sustaining consumer confidence and spending, two key drivers of the U.S. economy. If Americans feel secure in their jobs and job prospects, overall economic activity is likely to hold up.

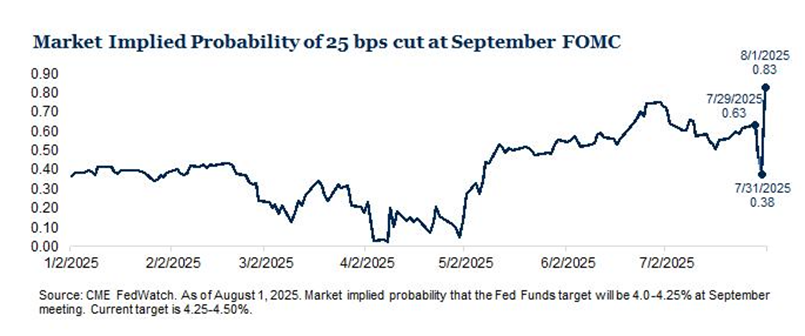

September Rate Cut Odds Rise Sharply After Fed Meeting

Market expectations for interest rate cuts have surged following the Federal Reserve’s most recent policy meeting. After months of uncertainty, a rate cut as early as September now appears likely. Projections rose to more than an 80% probability (over 90% at the time of this note) of a 25-basis point cut in September and two or more cuts by year-end.

CAISSA Perspective: This shift is being driven by a combination of softer economic data, particularly signs of a cooling labor market, and investor interpretations of the Fed’s latest commentary. Together these factors have reinforced the view that the Fed is preparing to ease policy in months ahead.

Of course, the outlook remains fluid. While recent trends support a more dovish stance, potential inflationary pressures such as renewed tariffs or trade restrictions could complicate the Fed’s decision making. As always, rate policy will depend on evolving economic data, and we continue to monitor these developments closely.

Strong Fundamentals, Stretched Valuations

The Forward 12-Month P/E ratio for the S&P 500 is hovering near 22x earnings, well above its long-term average. This premium reflects investor optimism but also raises the bar for companies to deliver on earnings expectations.

CAISSA Perspective: So far, the 2nd quarter results have been broadly encouraging. Many companies are managing costs effectively and producing solid earnings growth. However, markets rewarding selectivity with sector performance diverging and earnings misses are being punished more sharply.

With valuations elevated and expectations high, sustaining current market levels will require companies to deliver consistently strong results in the quarters ahead.