As we embark on another election cycle, we will undoubtedly suffer through several months of negative political ads. These often produce questions and concerns regarding the potential impact of the election results on client portfolios. Therefore, we felt it would be beneficial to analyze past presential election cycles and their impact on U.S. stock market returns.

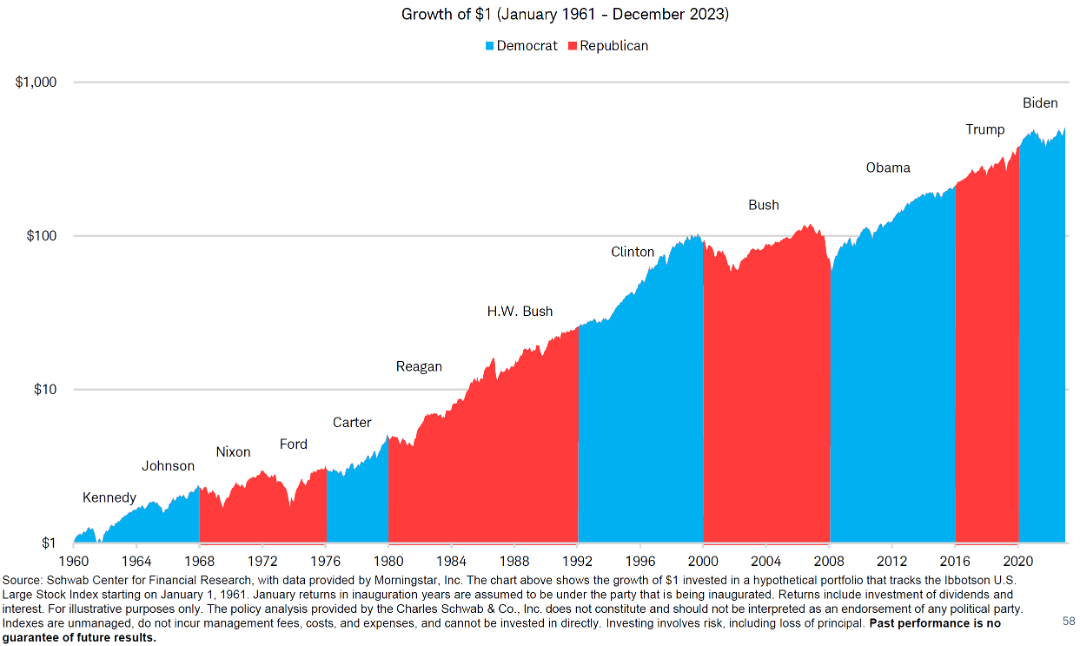

Historical data presents a compelling narrative that the office party has a limited direct impact on market performance. The accompanying chart showcases the growth of $1 invested in the stock market from January 1961 to December 2023, tracking the Ibbotson U.S. Large Stock Index. You can observe that regardless of whether a Democrat or Republican was in office, the overall market trend has been upward. It’s important to note that stock market growth is influenced by a complex interplay of factors, including economic policies, global events, and investor sentiment, rather than solely who occupies the White House.

This cycle, the critical driving factor for markets, remains looming Federal Reserve rate cuts, which historically have had a more tangible impact on market performance than the political party in power. At CAISSA, we’re closely monitoring the Fed’s actions and believe that there may be pressure on the Fed to act sooner than they would otherwise like to maintain the appearance of independence. While the election may bring a heightened level of discourse concerning economic policy, the Fed’s commitment to its dual mandate suggests that any changes in monetary policy, including rate cuts, will be driven by economic indicators rather than political timelines.

For our clients at CAISSA, this underscores the importance of maintaining a long-term perspective and a diversified portfolio resilient to short-term political and economic shifts. We encourage our clients to focus on long-term investment strategies that align with their financial goals and risk tolerance. The chart reaffirms that a well-diversified portfolio should be designed to weather the ups and downs over time rather than make significant changes based on political cycles. While the election’s outcome may be uncertain, our commitment to your financial well-being is unwavering.

By Ryan Zywotko, CFA CMT

Director of Investments