Overview

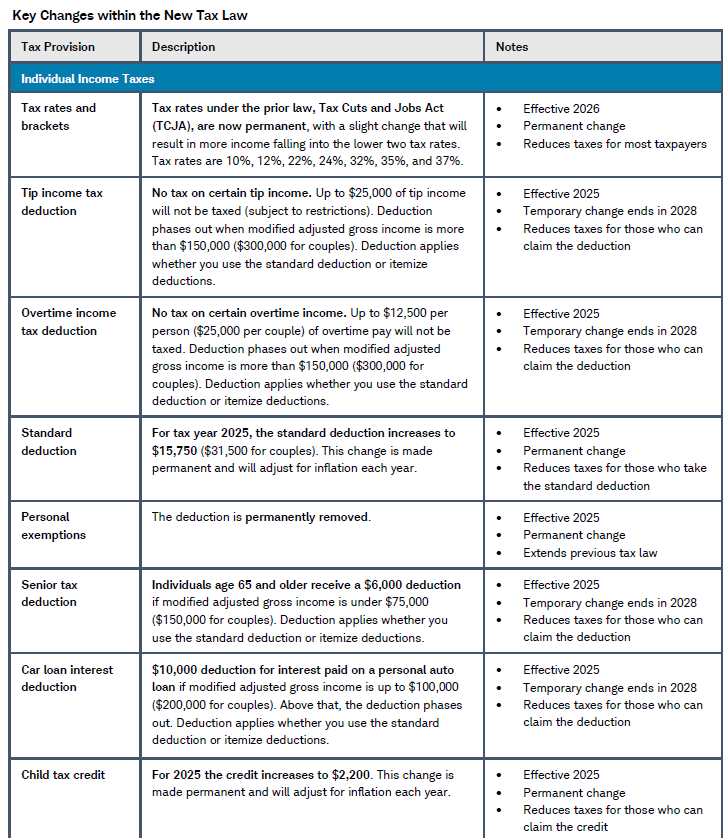

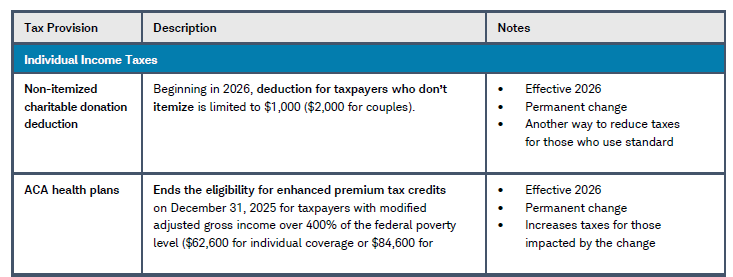

The One Big Beautiful Bill Act, signed into law July 4, 2025, includes significant tax law changes that will impact nearly all individual taxpayers. The new law extends or makes permanent many of the tax cuts enacted in 2017 and adds new tax deductions and increased tax credits. Overall, the law reduces taxes for the majority of taxpayers. Here are key provisions in effect today, as well as major provisions that will kick in over the next few years, and the potential implications of these changes.

Key changes with immediate tax implications for 2025

NEW Deduction: No tax on certain tip or overtime income.

Up to $25,000 of tip income will not be

taxed, subject to restrictions, such as applying only to certain lines of business. Additionally,

up to $12,500 per person ($25,000 per couple) of overtime pay will not be taxed. Both of these

deductions phase out for taxpayers with modified adjusted gross income of more than $150,000

($300,000 for couples). The deduction applies whether you use the standard deduction or itemize

deductions.

Effective: 2025 through 2028

What it means for you: If you earn tip or overtime income and are close to the phaseout limit,

consider tax bracket management strategies that could reduce your income, such as contributing to a

tax-deferred retirement plan.

NEW Deduction: Enhanced deduction for eligible seniors.

Individuals 65 and older with a modified

adjusted gross income under $75,000 ($150,000 for couples) receive a special deduction of $6,000

per qualified individual. The deduction applies whether you use the standard deduction or itemize deductions.

Effective: 2025 through 2028

What it means for you: If your income is close to the phaseout limit, consider tax bracket management strategies that could reduce your income. If you are working, this could be done by making contributions to a tax-deferred account. If you are in retirement, you could consider adjusting your withdrawal strategy to minimize income, such as using tax-loss harvesting or Roth distributions

NEW Deduction: Qualified car loan interest deduction.

For personal car loans originated in 2025 or later, borrowers can potentially deduct up to $10,000 of interest per tax year if their modified adjusted gross income is up to $100,000 ($200,000 for couples). The deduction phases out for those with income above that limit. Eligible vehicles include cars, minivans, SUVs, pickups, or motorcycles with final assembly within the U.S, among other rules. The deduction applies whether you use the standard deduction or itemize deductions.

Effective: 2025 through 2028

What it means for you: Only new or refinanced vehicle loans originated in 2025 count. Continuation of auto loan payments from previous years do not count. If you’re under the income threshold and interested in buying a vehicle, ask the dealer if the purchase is eligible for the deduction.

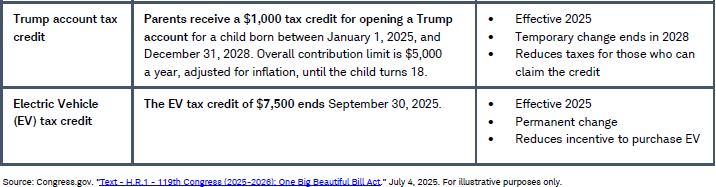

NEW Credit: $1,000 tax credit for opening a Trump account.

Dubbed a “Trump account” for newborns, parents can get a $1,000 tax credit for opening an account for babies born between January 1, 2025, and December 31, 2028. Parents, employers, or others can add up to an aggregate total of $5,000 a year, adjusted for inflation, until the child turns 18.

Effective: 2025 through 2028

What it means for you: While the tax credit is immediately available, these new accounts will likely take some time to roll out. If you qualify for the $1,000 tax credit, we suggest you take advantage of it (it’s “free” money after all) when the account becomes available, but beyond the initial $1,000, funding a 529 plan or a custodial Roth IRA may make more sense.

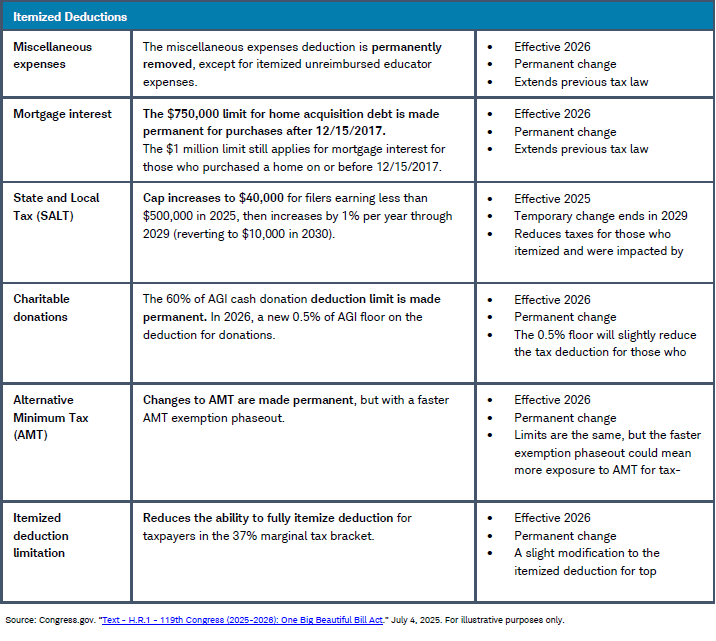

EXPANDED: Deduction for state and local tax (SALT).

The new law raises the cap from $10,000 to $40,000 for filers earning less than $500,000 in 2025 and increases the cap by 1% per year through 2029 (reverting to $10,000 in 2030).

Effective: 2025 through 2029

What it means for you: If you live in a high-tax state, this change could prompt you to itemize your deductions rather than use the standard deduction. If you are charitably inclined, this could be an opportunity to maximize your itemized deductions by increasing your giving. You may want to consider bunching charitable gifts into a donor advised fund or gifting highly appreciated stock to charity.

EXPANDED: Use of 529 plans.

Paying for professional certifications and continuing education courses are now qualified expenses for 529 plans. Eligible expenses for elementary and secondary tuition expanded to include online educational materials, tutors, and fees for standardized tests, AP exams, or for dual enrollment for college classes.

Effective: As of July 4, 2025. In 2026, the amount for elementary and secondary school expenses increases from $10,000 to $20,000 a year.

What it means for you: You now have more reasons to potentially fund and use dollars from a 529 plan. If you have an overfunded 529 plan and would like to use the funds to support your own professional education, we caution against doing so until this new provision is ironed out. Without additional clarity from the IRS, switching overfunded 529 plans to the parent may endanger eligibility to roll over funds to a Roth IRA later for the child.

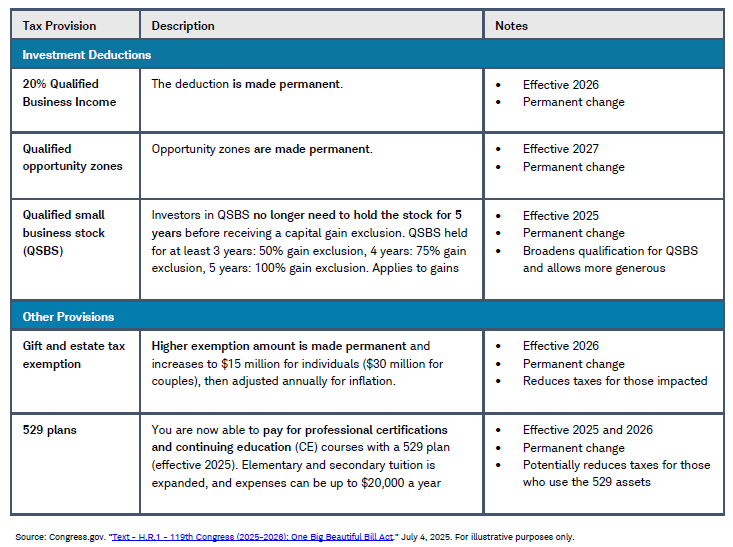

EXPANDED: Gain exclusion for qualified small business stock (QSBS).

Owners, investors, and employees who receive QSBS after July 4, 2025, no longer need to hold the stock for 5 years before receiving benefits from gain exclusion. QSBS will use 3 tiers for exclusion between 3 and 5 years and 50% to 100% gain exclusion for up to $15 million in gains adjusted for inflation after 2026. The company gross asset limit to qualify for “qualified small business” status increased from $50 million to $75 million.

Effective: As of July 4, 2025.

What it means for you: For current QSB stock owners, the new law won’t affect you. For newer small business owners, the law will add a new wrinkle to consider regarding business structure and stock ownership. For employees, there’s more potential opportunity to receive QSB stock at a firm at a slightly later stage of development.

ENDING: Tax credit for green energy.

The new law winds down most of the tax credits approved by Congress in 2022 as part of the Inflation Reduction Act. As a result, the $7,500 tax credit for the purchase of an electric vehicle (EV) is eliminated for vehicles purchased after September 30, 2025.

What it means for you: If you’re considering purchasing an electric vehicle, now may be the time to act to ensure you don’t lose out on the credit. But remember, income limitations apply, so talk with a tax advisor before acting.

ENDING: Enhanced premium tax credits for ACA health plans.

The new law ends the eligibility for enhanced premium tax credits on December 31, 2025, for taxpayers with modified adjusted gross income over 400% of the federal poverty level ($62,600 for individual coverage or $84,600 for a couple in 2026). Premium tax credits for taxpayers at or under 400% of the federal poverty level (FPL) will remain.

What it means for you: Early retirees will need to be prepared for higher premiums and out-of-pocket costs in 2026. The 400% FPL will now be a cliff. If you make $1 more than the limit, no premium tax credits will be available. If you are close to the 400% FPL and you can exert some control over your income, you should consider tax bracket management strategies that could reduce your modified adjusted gross income.

Bottom line

Though it may be tempting to make immediate changes to your tax and financial plans based on the new tax law, we recommend a more cautious approach of working with your tax and financial advisors to see how these changes may impact your specific situation. Together, you can help ensure any actions or changes fit into your overall plan to meet your financial goals.

https://www.schwab.com/resource/scfr_2025taxbill