A Guide to Deducting your Home Equity Line of Credit

A Guide to Deducting your Home Equity Line of Credit

Do you have a line of credit on your house or vacation house and wondering if you can deduct the interest on next year’s tax return? We have answers for you!

Written by Kelly S. Olson Pedersen, CFP®, CDFA

The Tax Cuts and Jobs Act of 2017 left many homeowners hanging on whether or not they could deduct their Home Equity Line of Credit (HELOC) going forward. The first interpretation was that it was NOT going to be deductible on the tax return in the future, which left many people with a loan that they could no longer deduct the interest they were paying. Here are the guidelines to best manage your money and home equity loan allocations.

The IRS came out this February to clarify the matter and there’s good news! If you used your HELOC for the benefit of the home securing the loan, you can still deduct those interest payments! If you had used the proceeds from the line of credit to buy new clothes and a fancy car, you will find yourself out of luck trying to deduct the interest.

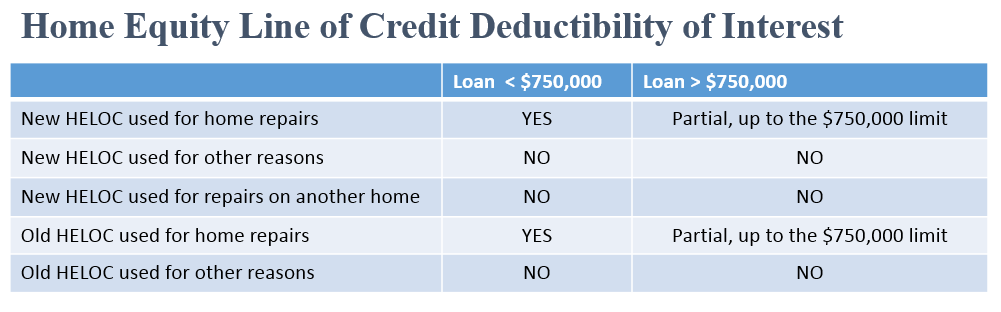

Here are a few of the rules and a quick summary chart for reference (all numbers are for a joint return):

- Deductible: A new or old HELOC used to repair the house that is securing the loan. Only the interest on a loan LESS than $750,000 will be deductible though (down from $1 million). That maximum amount takes into account the cumulative of all loans on the house. So if there are three loans on the house, they are combined to reach the maximum of $750,000. All interest on the loan amount above that is not deductible.

- NOT deductible: Taking out a HELOC on your primary home to buy or repair your vacation home

- Deductible: Taking out a HELOC on your vacation home to repair or upgrade your vacation home

- Partially deductible: Taking out a $500,000 HELOC on your home AND a $500,000 HELOC on your vacation home to upgrade each house respectfully. Combined, the loans exceed $750,000 so the interest on $750,000 will be deductible and the rest will not.

Caissa Wealth Strategies is a fee based registered investment advisory firm, specializing in personal, dynamic wealth management. Based in Bloomington, Minnesota, Caissa financial planning professionals provide individualized strategies for every client. You can expect more from CAISSA, and in turn, you will get a fiercely loyal advocate on your side. For more news and information on wealth management solutions, visit Caissa Wealth.