Acronyms Matter: Why you should work with a financial advisor who is a CFP®

By Kelly S. Olson Pedersen, CFP®, CDFA

It can seem like alphabet soup. CFP®. CDFA. CFA. CPA. CIMA. As confusing as it may seem, those acronyms truly do matter when it comes to who you want managing your money.

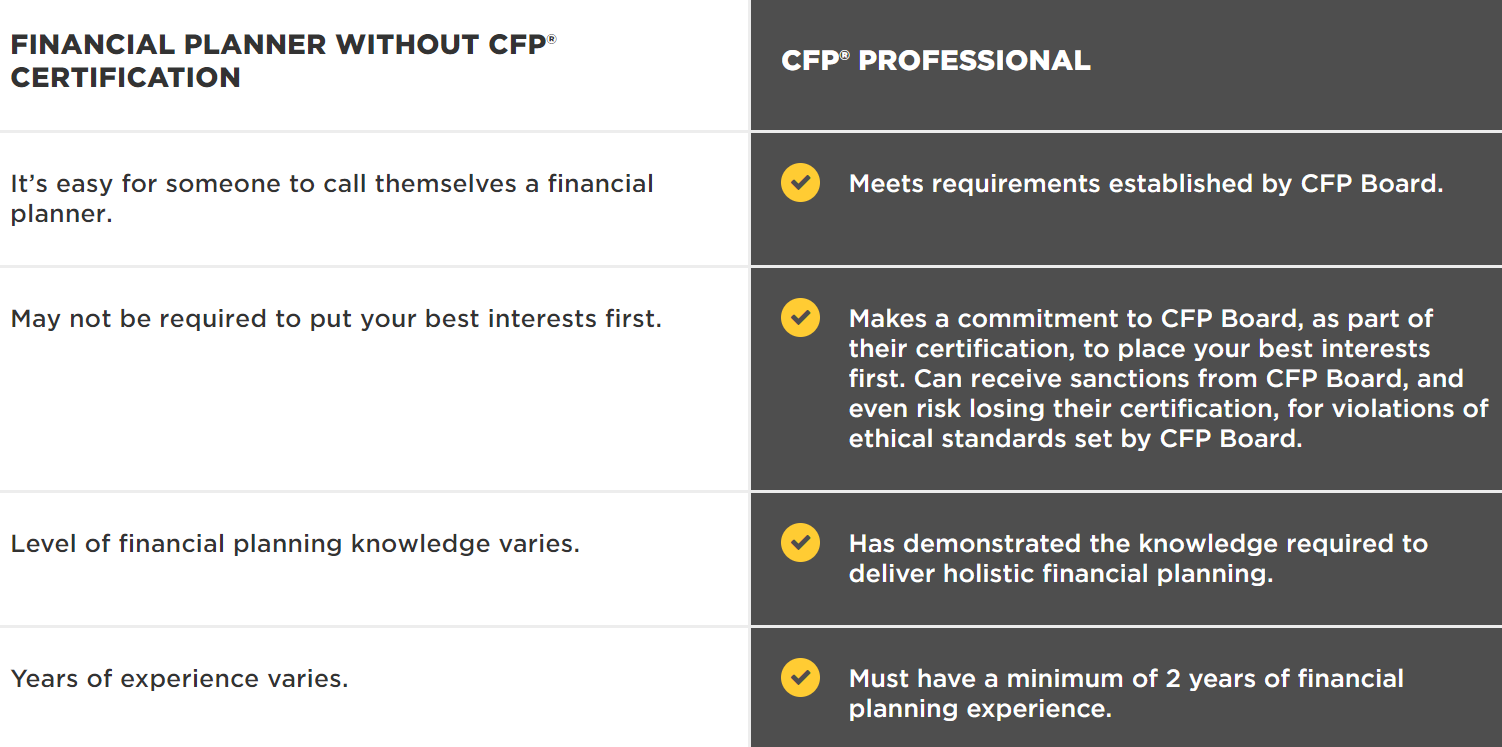

Perhaps the most important of those acronyms is the CFP®, which stands for CERTIFIED FINANCIAL PLANNER™. CFP®s are financial professionals who have met extensive training and experience requirements and commit to the CFP® Board’s ethical standards that require them to put their clients’ best interests first. CFP® professionals take a holistic, personalized approach to bring all the pieces of your financial life together.

Think about it. Would you allow someone to prepare your tax returns who is not a CPA? Probably not. So, why would you have someone manage your assets who does not meet the fiduciary standard of a CFP®?

That is why all advisors at CAISSA are CFP®s. We take your best interests very seriously and the CFP® designation ensures we never waver in that commitment.

The more complex your financial situation becomes, the more important it is to work with a CFP®

Particularly for entrepreneurs, business owners, and families of wealth, working with a CFP® is critically important. As your wealth grows, so does the complexity of your financial situation. Beyond managing your investment portfolio, there is the need for philanthropic planning, estate planning, tax planning, legacy planning, etc. The list goes on. Of course, none of those elements of your overall financial plan should be addressed in a silo. They should be thoughtfully considered as part of a strategic whole, because one element of your financial plan inevitably affects another. A CFP® will have the training and experience to take the holistic approach that higher levels of wealth demand.

A higher ethical standard

Importantly, a CFP® is held to a higher standard of ethics than financial advisors who have not achieved this credential. CFP®s must uphold the code of ethics and standards of conduct set by the CFP® Board, which go above and beyond what is required by the SEC (Securities and Exchange Commission). A CFP® is bound by the fiduciary standard, which states that a client’s best interests must always be front and center, with no conflicts of interest.

So, what specifically should you look for when researching CFP®s to work with? The CFP® Board provides the following 10 questions to ask:

- What are your qualifications and credentials?

- What services do you offer?

- Will you have a fiduciary duty to me?

- What is your approach to financial planning?

- What types of clients do you typically work with?

- Will you be the only advisor working with me?

- How will I pay for your services?

- How much do you typically charge?

- Do others stand to gain from the financial advice you give me?

- Have you ever been publicly disciplined for any unlawful or unethical actions in your career?

When you work with a CFP®, you can enjoy the peace of mind that you are working with a financial professional with the skills and experience to develop a plan that brings together your entire financial situation, and who will do so with your best interests at heart.

Explore whether a CFP® is the right choice for your situation.