CAISSA Investments: Market Update | June 2017

Written by Kelly S. Olson Pedersen, CFP®, CDFA

CAISSA Investments: Market Update | June 2017

Caissa portfolio management in June

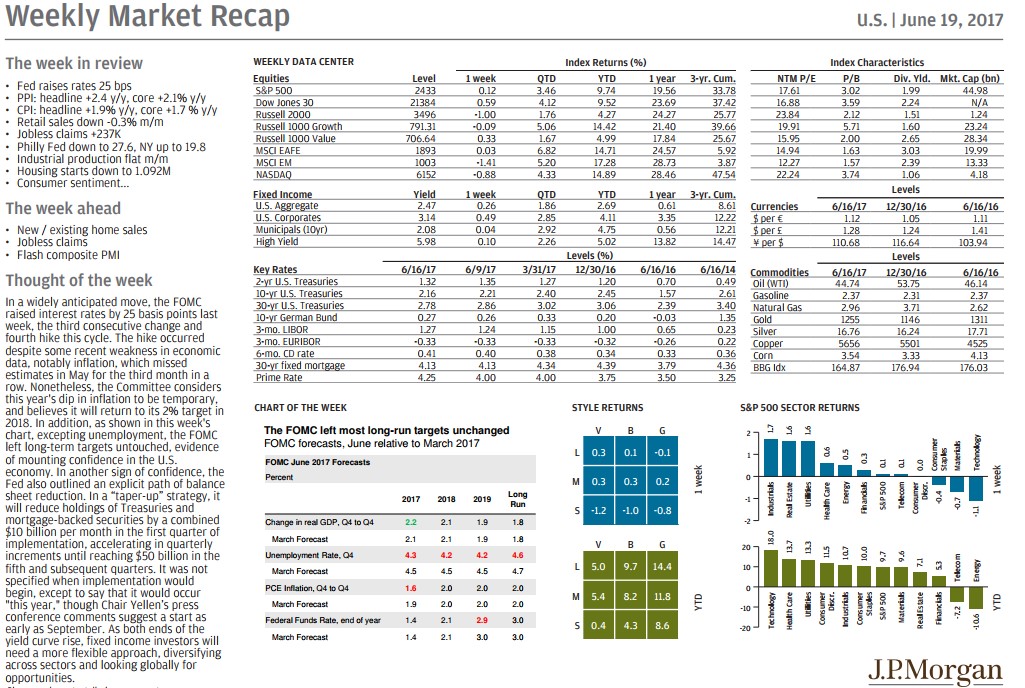

As of the end of June, we were still taking profits off our large cap equities and redeploying them into international equities. As the market continues to run up, we will continue with this process. We have been targeting managers that have a heavy weighting in technology as those stock have run up very quickly. While fixed income is still not an attractive place to be, we continue to maintain a position there; but instead of beefing it up, we are adding alternative types of fixed income to the portfolios.

The Fed did raise interest rates about .25% this month but I wouldn’t expect to see that reflect in your own personal bank accounts immediately. The Fed is still targeting a 3% rate by 2019 as their goal, so we will sit tight in our bond allocations until then – there is no need to buy into a rising rate environment.

As mentioned previously, we are seeing the tides start to turn internationally. In the past, we have kept a minimal allocation to emerging markets and international stocks; however we have recently decided to start increasing our allocations by 1-3% for clients. You may be seeing more trade confirms than you’re used to in the past, as we are taking profits as they are earned and reallocating them so that the portfolio doesn’t become overwhelmingly susceptible to a market downturn.

I hope you are all enjoying your summers!