CAISSA Investments: Market Update | April 2017

Written by Kelly S. Olson Pedersen, CFP®, CDFA

CAISSA Investments: Market Update | April 2017

A tip for all of our clients

Clients may be reviewing quarterly performance reports sent to you electronically this month. While the balance of your Schwab statements and the balances on your performance report will be exactly the same, the story the numbers are telling you are very different.

Your performance report is just that. It is calculating how your account is performing by looking at your balances, adding in the income you are receiving (as well as the asset growth) and subtracting any fees, etc. Only on the quarterly report that is emailed to you will you find out “how your accounts are doing?”

Contrary, Schwab’s monthly statements, that they relentlessly send you, simply state the balance of your account and the TAXABLE gains/losses for each position. THIS IS NOT PERFOMANCE!

Here’s a dramatic example:

Let’s say you’ve owned ABC stock for the last ten years and it was up 10% every single year for ten years. ABC stock has an annual return of…. You guessed it…. 10%!!! Say you sold this stock in November and then bought it right back shortly after the sale. Immediately after buying it back, the stock tanks 20% in just a few weeks. You might look at your December Schwab statement and immediately think that ABC stock is performing terribly since it’s “down” 20%. The reality is, the performance you for the last 10 years is now just a hair less than 10% annualized. The negative 20% only comes into play if you sell that position again… as a TAX Loss representing only a few week’s time.

The moral of the story is, don’t look at what your Schwab screen shows as your performance. ONLY your quarterly performance report will accurately portray how you are doing. The rest…. It’s just about taxes. J

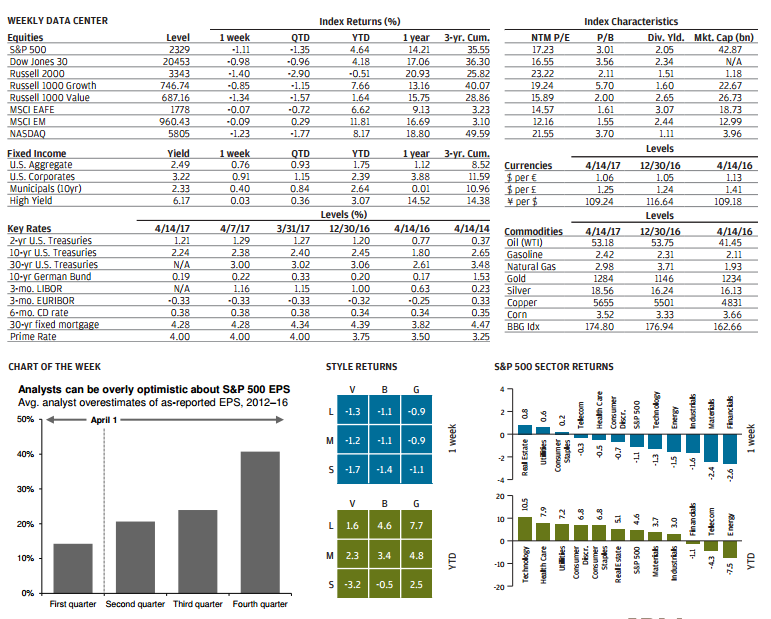

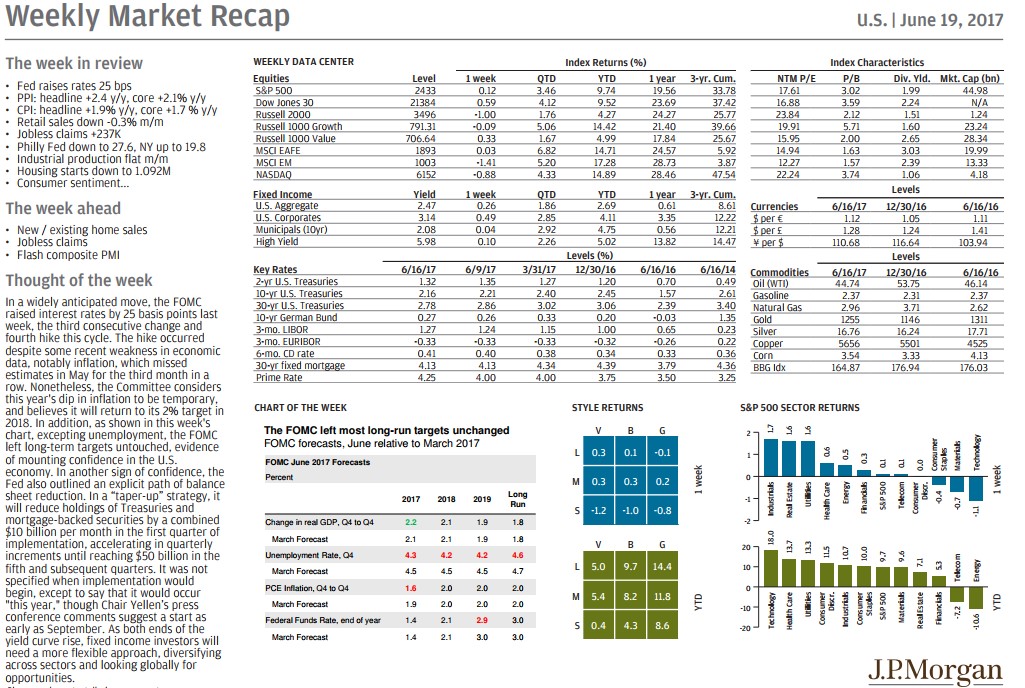

Recap of the markets through April 17th: