CAISSA Updates: Market Update – Hedging Strategies

CAISSA Updates: Market Update – Hedging Strategies

Written by Kelly S. Olson Pedersen, CFP®, CDFA

When the stock market starts to pull back and decline (the average intra-year decline is about 14% every year going back 36 years) you may wonder…. “Do I have enough allocated to bonds so I don’t get hit like in 2008?” There is a different way to think about this.

When the stock market goes down, a client typically needs a “hedge” to help their portfolio through the downturn. This does not mean the stereotypical Wall Street hedge fund, but something that acts differently than the market to buffer the volatility. To help illustrate that it’s “not just bonds” here are some examples of the “hedging” strategies we use at CAISSA.

Bonds: They are a FANTASTIC hedge against the stock market having very little correlation. However, bonds aren’t yielding much interest these days and money market funds are still typically yielding less than 1% so we cannot use bonds as our ONLY hedge. We need to find other tools.

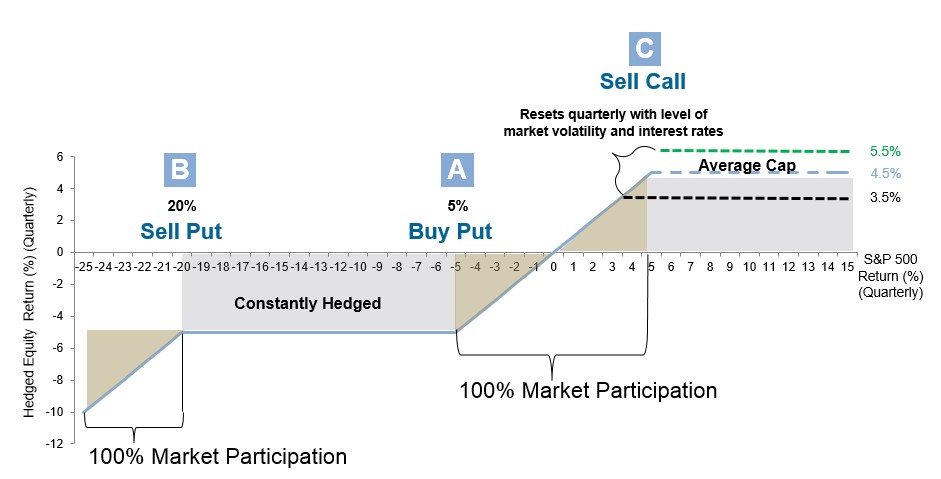

Downside protection: Currently we use an option strategy (buying and selling puts and calls) that will limit declines in that investment to a negative 5% in any given quarter (capped at negative 20%). So if the market declines 18% in one quarter, we are only down 5% in that investment. This a great hedge against the stock market and it also allows us to participate in approximately 3.5% to 5% upside in any given quarter. While this is riskier than a bond, it has much more upside potential as well. If you are a CAISSA client, you most likely have this in your portfolio.

Gains when the market is down: The strategy CAISSA uses here is a long/short strategy that has previously proven that in periods of negative market returns, this investment can provide a positive return. Here is an example of how this works. Let’s say the investment manager thinks that the housing market will boom, so they long Home Depot, but they also short Lowe’s to hedge their bet. This strategy was EXTREMELY helpful in the fall of 2015 when the stock market was consistently posting negative returns, this manager was posting positive returns. Again, if you are a CAISSA client, you will likely own this investment.

Income, not related to a stock: In this strategy, we look at it like a longer term and higher yielding bond that has very little relation to the stock market. The goal of the portfolio is LIBOR + 6-8% but we are targeting 6%, just to be conservative. This investment also hedges your risk in the stock market and will increase income as interest rates rise. Many of our accredited clients at CAISSA own this as well.

So as you can see, bonds are not the only player in town when it comes to hedging your portfolio against market downside. We tend to look at portfolios in three pools: Bonds in the first Tranche, alternative or multi-assets in the second Tranche and the equities in the Third Tranche. As a Rule of Thumb, add the first Tranche to about 50% of the second Tranche and that is approximately how much you have “hedged” against the stock market.