CAISSA’s Investment Update: Chart of the Month

CAISSA’s Investment Update: Chart of the Month

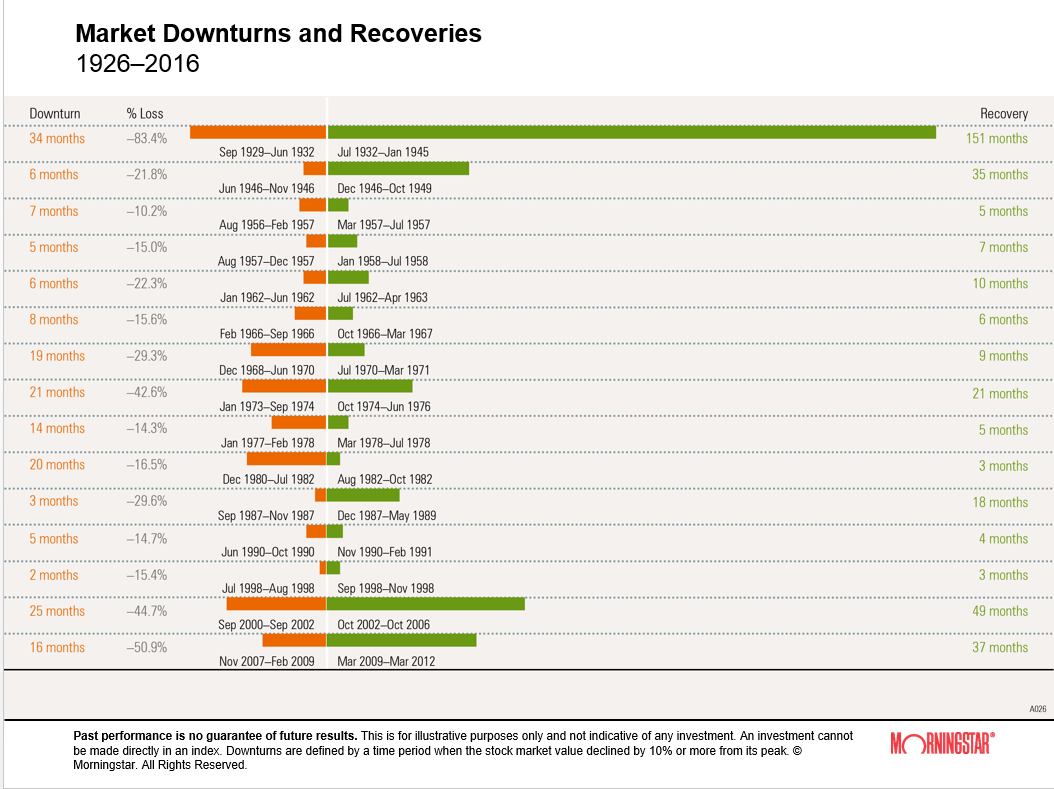

Market Downturns and Recoveries

The investment update and chart below are a great example of why we apply our Tranches of Income strategy to our asset allocations. Going back to the Great Depression, there have been 15+ major downturns in history. Only three of these downturns took more than 36 months to recover (one of which WAS the Great Depression). The others averaged about 18 to 36 months.

The Great Recession of 2008 only lasted 16 months, but to most investors, it felt like ETERNITY. It then took about three years for people to make their money back. The whole process lasted about five years from start to finish. That’s why at CAISSA, we ALWAYS keep about 5 to 7 years of withdrawal needs earmarked in short term instruments. It may feel a little boring, but that’s the point! When the next market downturn happens, our clients will have the assurance that they will still meet their cash flow needs.

Even if you’re not retired, you can still rest easy because downturns are natural… but so are recoveries! Our strategy is to plan for and make the most of downturns to reach your specific financial management goals.

Caissa Wealth Strategies is a fee based registered investment advisory firm, specializing in personal, dynamic wealth management. Based in Bloomington, Minnesota, Caissa financial planning professionals provide individualized strategies for every client. You can expect more from CAISSA, and in turn, you will get a fiercely loyal advocate on your side. For more news and information on wealth management solutions, visit Caissa Wealth.