Chart of the Month: Are We in a Recession?

Chart of the Month: Are We in a Recession?

By Kelly Pedersen, CFP®

Whether or not the U.S. is going into a recession is on the minds of many of our clients and colleagues. Common misconceptions are that a recession is narrowly defined as:

- A drop in the five economic indicators: real gross domestic product (GDP), income, employment, manufacturing and retail sales.

- When the GDP growth rate is negative for two quarters in a row.

- When the economy declines significantly for more than 6 months.

While many of these factors may be part of a recessionary environment, it is not how a recession is defined. Instead, the National Bureau of Economic Research (NBER) defines a recession as a “period of falling economic activity spread across the economy, lasting more than a few months.” The NBER is a panel of more than 1300 economics and business professors who provide research and is the official voice of recessions. The NBER uses judgment and expertise along with statistics to decide when a recession started – most often after it has already started.

In reality, there is no one indicator that forewarns us that we are in a recession. So how will we know when we are there? Typically the main driver of a recession is slowing growth. Slow growth stuns expansions, leads to layoffs and the halting of new hires. By the time this is happening, the recession is well underway. Instead, we tend to look at leading indicators like the yield curve, GDP and earnings growth.

While an inverted yield curve is one of the most widely talked about leading indicators, it cannot predict a recession on its own. It is, however, one of the most widely watched indicators. It has successfully predicted more than half of all recessions with an inversion happening about 22 months before the start of a recession on average.

Earnings growth has slowed incredibly from 2018 with expectations going into the year of about 7-7.5%. That number is now down to about 2-2.5%, according to FactSet.

Gross domestic product (the main measure for U.S. growth) is a very important piece of the economy to judge for recession. There are some concerns about weaker sectors in the economy right now, namely manufacturing, that could weigh on growth.

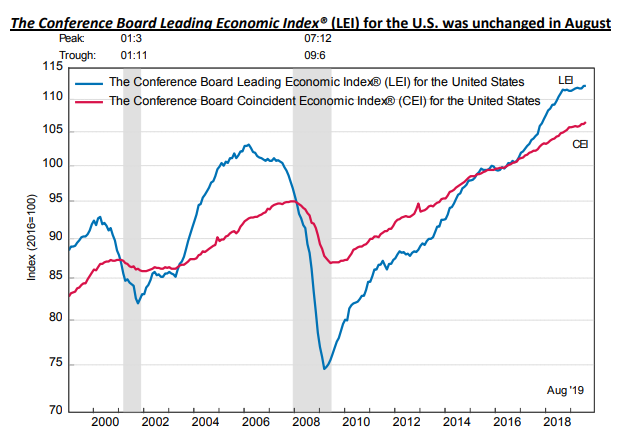

One of the main signals CAISSA looks at and studies is the Conference Board’s Leading Economic Index. The Conference Board is a member-driven think tank that provides trusted insights for economic things laying ahead. They have put together a 10-component index called the Leading Economic Index (LEI) to try to predict the start of the next recession. The design is to be more precise than using any one indicator to shed light on turning points and patterns simply because it smooths out some of the volatility of the individual components that may have outside factors affecting them.

The Conference Board issues a monthly commentary and a monthly report for all to research. The ten components they aggregate are:

- Average Weekly Hours, Manufacturing

- Average weekly initial claims for unemployment insurance

- Manufacturers’ new orders, consumer goods and materials

- ISM® index of new orders

- Manufacturers’ new orders, nondefense capital goods excluding aircraft orders

- Building permits, new private housing units

- Stock prices (By the S&P 500)

- Leading Credit Index™

- Interest rate spread, 10-year Treasury bonds to federal funds

- Average consumer expectations for business conditions

As of August, the LEI is running flat month over month and indicates the expansion should continue through the remaining part of 2019 with the pace of growth remaining moderate. In recessions past, the LEI turned negative sharply in the months leading into a recession. We are not seeing those numbers right now, but the odds are growing that we could see a pivot in 2020. We are likely on the precipice of a period before a recession begins and the Federal Reserve will cut rates again, beginning the cycle. It is likely that manufacturing, as its own sector, could be already in a recession.

Armed with the information above and understanding the Fed may likely cut rates again, the place to be historically is the equity markets – but in the high quality space. Also, increasing credit quality of fixed income assets. We are maintaining our weight in equities for now until we see a few of the leading economic indicators turning for the worse. Then the stock market tends to turn into a leading indicator of a recession to come.

Caissa Wealth Strategies is a fee based registered investment advisory firm, specializing in personal, dynamic wealth management. Based in Bloomington, Minnesota, Caissa financial planning professionals provide individualized strategies for every client. You can expect more from CAISSA, and in turn, you will get a fiercely loyal advocate on your side. For more news and information on wealth management solutions, visit Caissa Wealth.