Chart of the Month: Fixed Income Yields & Returns

Chart of the Month: Fixed Income Yields & Returns

Written by Kelly S. Olson Pedersen, CFP®, CDFA

The bottom line is that many bond mutual funds own MANY different types of bonds and various maturities. If you don’t know what is inside your bond mutual fund, you should ask your personal financial advisor so you don’t get whipsawed by a rising rate bond market and a declining stock market!

How a normal bond pays you

When you purchase a singular bond and lend a company money, for say $10,000 for five years at 3%, you are issued a bond certificate indicating you will get paid $300/yr until the bond matures in five years. If you hold the bond until five years, you will get repaid the $10,000 you lent the business.

If you sell the bond before that, you will have to sell it to another investor wanting that bond and its “coupon” payments. This is where interest rates start to affect your bond. If you sell your bond about two years in and interest rates have now moved from 3% to 4%, your bond isn’t as attractive because someone else can get 4% on a new bond so your fair market value goes down. If you choose to sell your bond at this time before maturity, you may only get $9,700 back instead of $10,000 because it’s less valued by other buyers. If you just hold it to maturity, you get your $10,000 back and you can reinvest it.

The rule of thumb is for as many years of your bond’s maturity (or duration), it will decrease in value as much as a percent with a 1% rise in interest rates. So a 1% rate hike on a five-year bond may likely deliver a loss of paper value of about 5%. I say paper value because you may look like you’re losing money but that only becomes reality if you SELL it before it matures.

So the bottom line is that in a rising interest rate environment, you can expect the paper value of your bonds to go down.

Here are some ideas for how to invest in a rising rate environment:

• Buy individual bonds that you can hold to maturity and you can avoid selling the bond at a discount.

• To diversify, buy baskets of bonds that all mature in the same year and hold that basket until maturity.

• Keep your maturities shorter if you are holding to maturity and reinvest in higher rates as they mature.

• If you are actively buying or selling, then try to buy around the fulcrum of the yield curve so you can hold to maturity if you want or sell if the pricing works in your favor.

• Ladder your maturities and spread out their diversity so you aren’t concentrated in just a few issues.

• If you own a bond mutual fund, KNOW what it owns. Not all bond funds are alike and typically the higher the yield, the higher the risk. Some bond funds can carry almost as much risk as an equity.

At Caissa, anything we put into our fixed income allocation is meant to act as a core bond and have minimal risk. It’s there to earn income, preserve capital and hedge the stock market as a Tranche 1 investment. All other types of bonds will fall into an alternative category and Tranche 2 for investments because they carry different risks and will act differently in a rising rate environment. In a rising rate environment, we do not own bond funds and are holding our short term bonds to maturity.

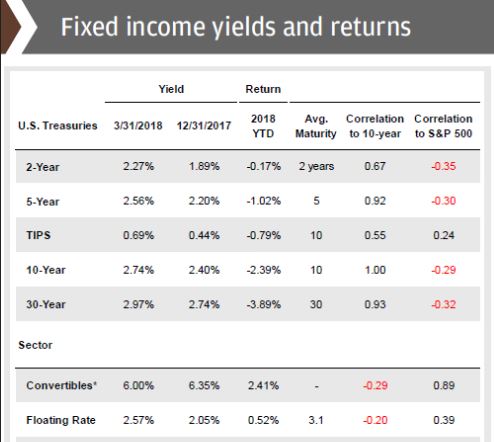

Different kinds of bonds do different things in a rising rate environment (see below)

This chart shows how a 1% rate increase affects various types of bonds (on the right). As you can see, bonds will react very differently depending on the type of bond. Convertibles have the best total return while 30-year treasuries are having the worst. Some of the best “types” of bonds for return are the convertibles, floating rate and high yield. However, these bonds do not come without risk so understanding the yield spread is essential. For example, high yield bonds have a .72 correlation to the S&P (that is HIGH). Whereas a 2-year treasury has a negative correlation to the stock market. The shorter the maturity, the less the impact on the bond.

The bottom line:

Many bond mutual funds own MANY of these types of bonds and various maturities. If you don’t know what is inside your bond mutual fund, you should ask your financial advisor so you don’t get whipsawed by a rising rate bond market and a declining stock market!

Caissa Wealth Strategies is a fee based registered investment advisory firm, specializing in personal, dynamic wealth management. Based in Bloomington, Minnesota, Caissa financial planning professionals provide individualized strategies for every client. You can expect more from CAISSA, and in turn, you will get a fiercely loyal advocate on your side. For more news and information on wealth management solutions, visit Caissa Wealth.