CHART OF THE MONTH: Market Volatility

CHART OF THE MONTH: Market Volatility

Between the crisis in Ukraine and the surge in inflation, volatility and uncertainty seem to be everywhere. In our latest chart of the month, we explore why sticking to a well-thought-out financial plan can serve you well in the long term, especially during periods of turmoil.

CHART OF THE MONTH: Market Volatility By Kelly Pedersen

Market volatility seems to be the norm recently. And no surprise. Between the crisis in Ukraine and soaring inflation, investors are jittery to say the least. There are unknowns in the short term in any market. We don’t know where Russia will stop. We don’t have a sense for where wheat and oil prices will top out. We don’t know how fast the Fed will raise rates until they do.

Not knowing is OK, as long as you have a financial plan that is built for uncertainty. That’s what we do at CAISSA.

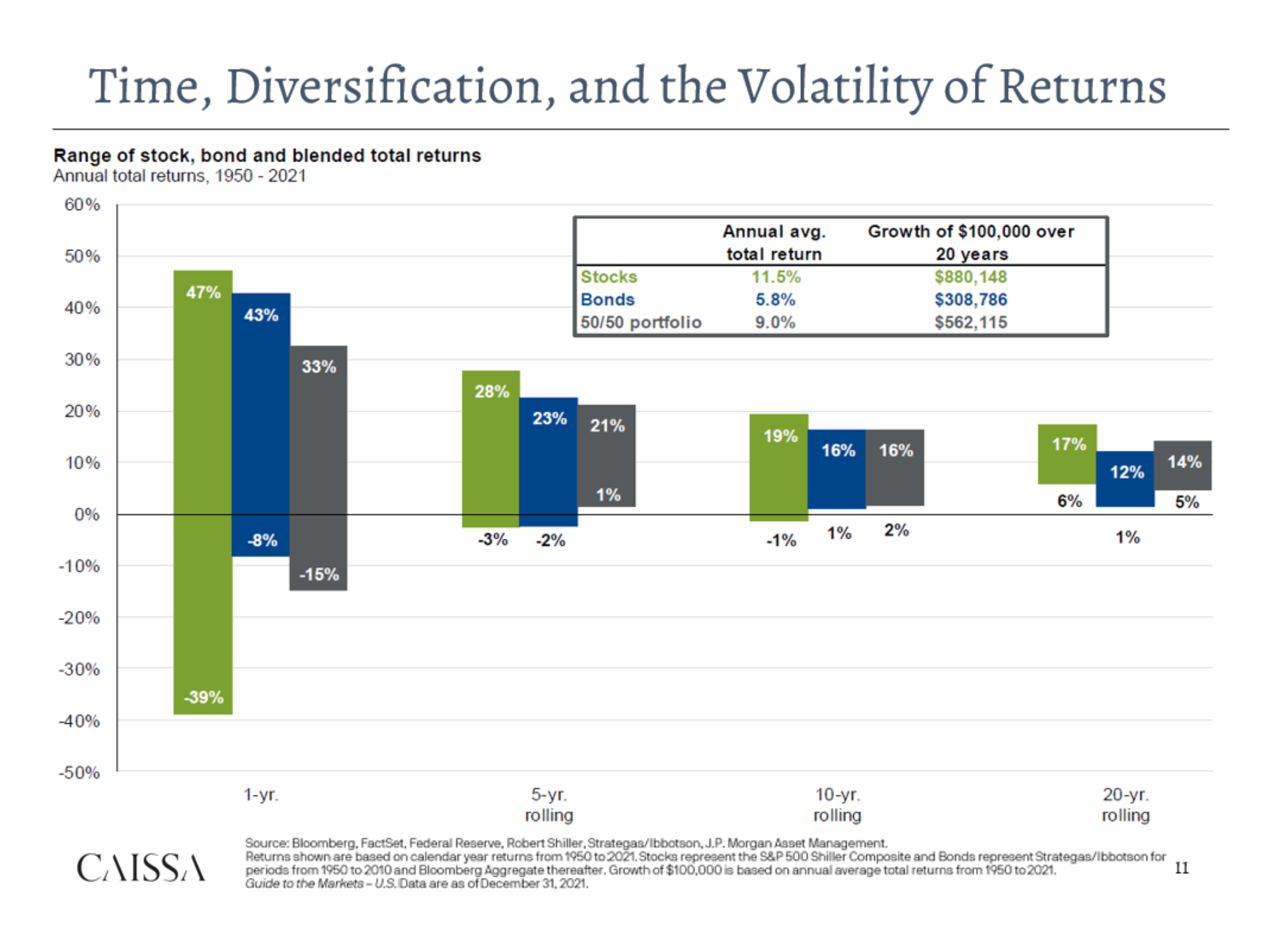

At CAISSA, we build portfolios that are designed to withstand the noise and sustain long term returns. Consider this: the worst five-year return for the S&P 500 over the last 70+ years is negative 3%. For one year it is -39%. That’s a huge difference, and shows the power of long-term investing and sticking to a plan. If you add bonds at a 50/50 ratio with stocks, then your worst one-year return is -15%and your worst five-year return is 1%. Again, by staying focused on a rolling five–year return can reduce the feeling of anxiety caused by short-term volatility. That’s the CAISSA way.

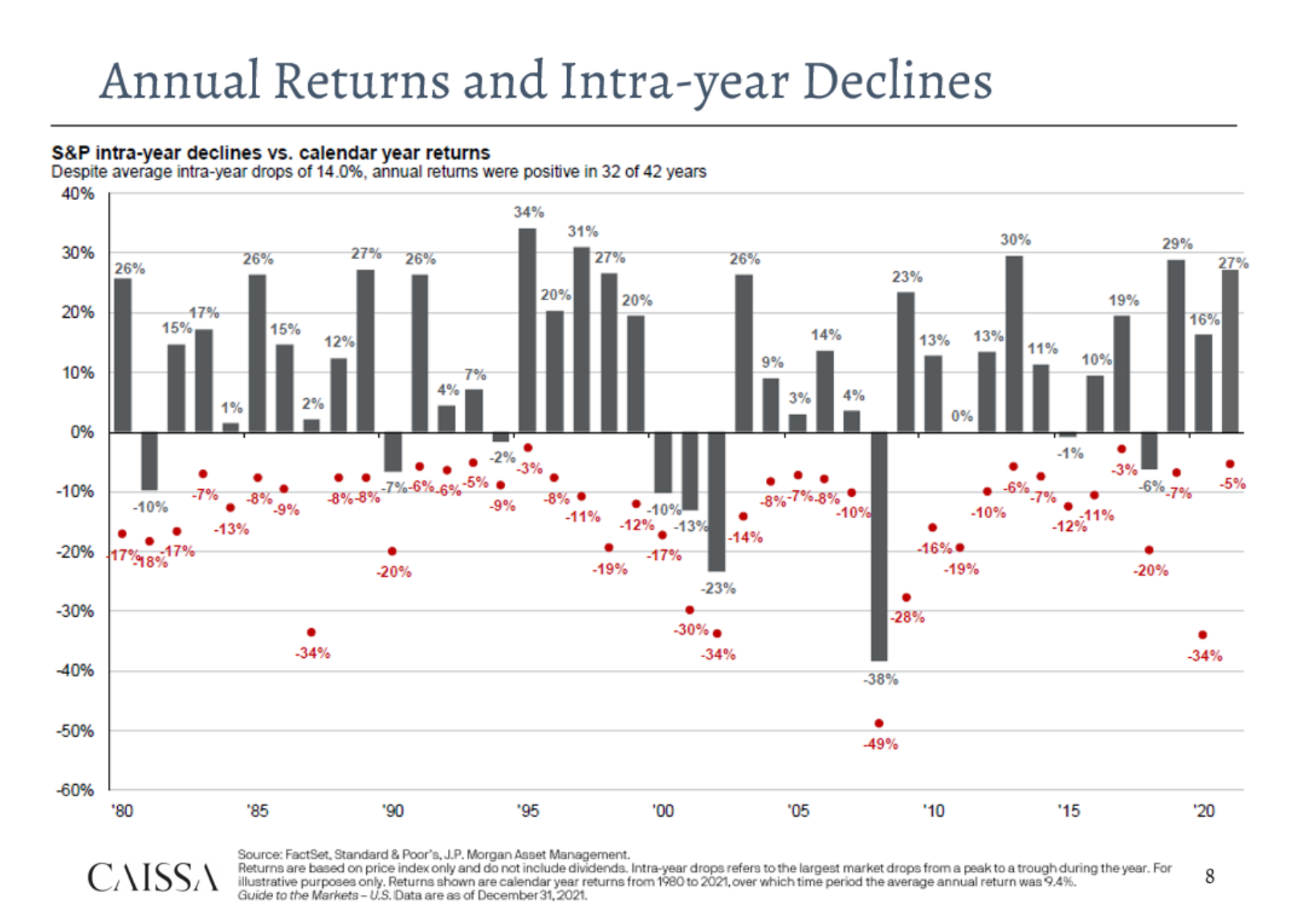

To put it into perspective, every year for the past ~ 40 years, the stock market has had an average INTRA year decline of about -14%. Many of those same year found the market ending the year with positive gains!

CAISSA allocates portfolios to weather the vast swings in markets, with your goals in mind. There will be times that performance is ahead during the year and other times it will lag.. The point is your personal financial plan was built for this reality. Your “tranches” are designed to meet both your immediate lifestyle needs, as well as your long-term goals and aspirations. . We are continually reviewing this allocation model, tending to it and worrying about it so you do not have to.

In times of heightened geopolitical tension, it’s only natural to worry about investment risk, security and cyber issues. Rest assured that CAISSA has robust policies in place to protect your assets and your privacy. . Our partner Schwab has top-notch cyber security, adding an extra layer of protection.

The current state of affairs can feel unsettling to say the least. Take heart knowing that all of us at CAISSA are working diligently to provide you with the peace of mind you desire and deserve. Please call if you have any concerns or just want to chat.