Market Volatility … a painful vacillation between fear and greed

At CAISSA, we are having many conversations about the issues that are driving market volatility.

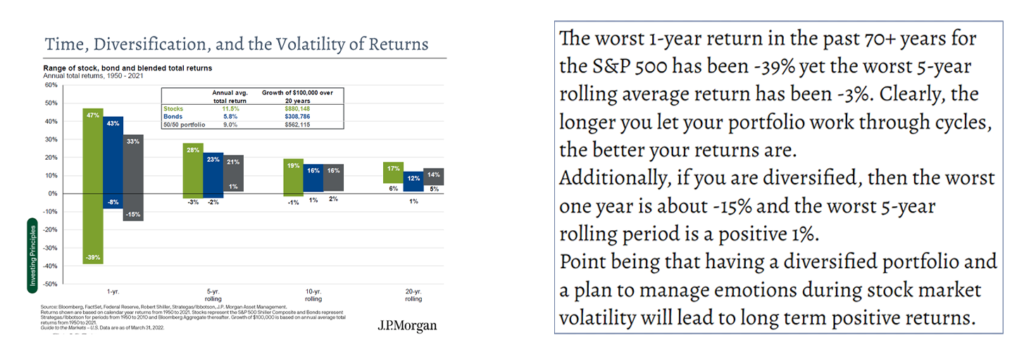

First and foremost, for those who want to make the most of the current environment, it is not about timing the market but about time in the market. It is nearly impossible to time the market, and while it can be unbearable at points, the long run is where to set your sights. Take the following graphic:

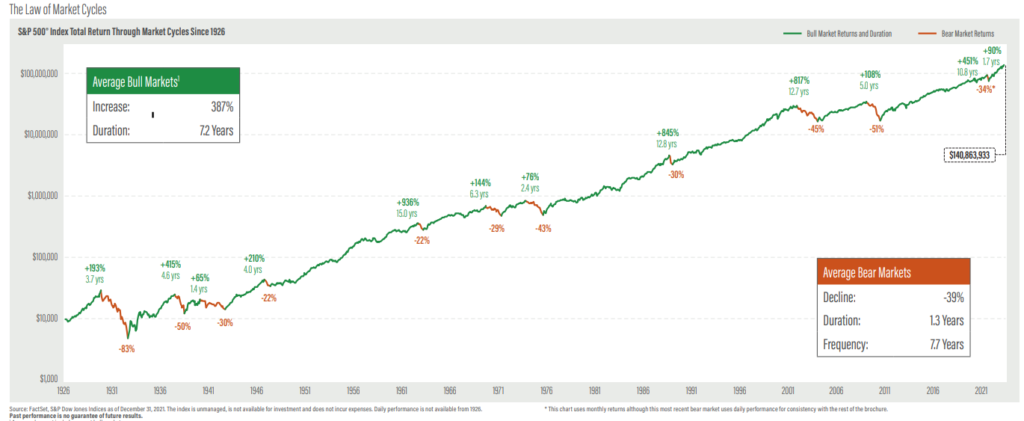

We’ve been through this before. While we may not have seen these exact circumstances, we have experienced similar turbulent cycles, only to see the market heal. Our economy is incredibly resilient. It’s easy to look at the chart below and wish you could go back to each of those orange-colored downturns and put all your money in the market at those times. Of course, that is impossible to time correctly, which makes it all the more important to manage our emotions going forward to make the most of the next market downturn.

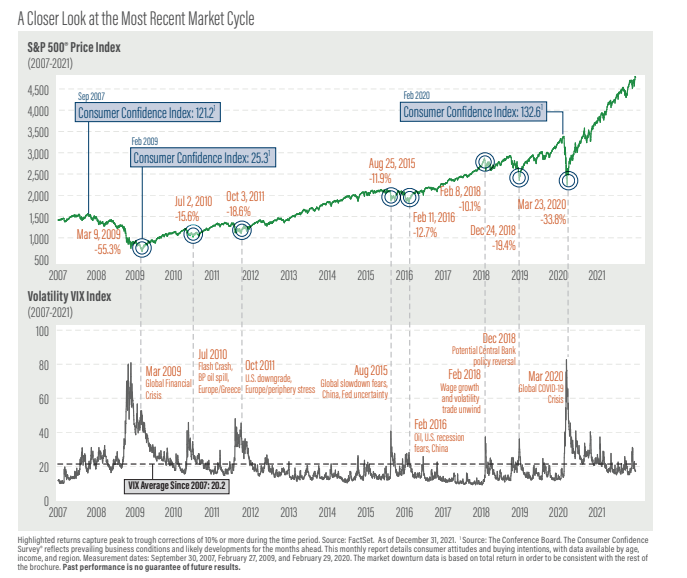

You still might be saying to yourself, “We really have never seen this before.” Again, every downturn is unique, and we certainly felt a sense of “doom and gloom” in many of the past volatile market cycles. Each of the events shown below felt pretty tragic, but the market prevailed long term.

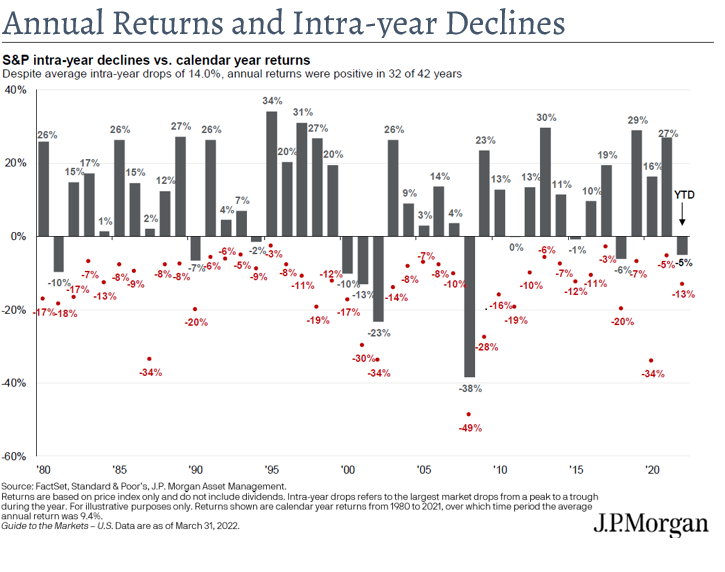

Clearly, market volatility is very unsettling, but it is not abnormal. On average over the past 40+ years, the S&P 500 declined 14% at some point intra-year, and over 75% of the time, still posted a positive annual return! In other words, historically, it has been healthy to have pullbacks. We had not had a meaningful pullback since March of 2020. While statistically we are due for a retreat, it was also a culmination of events compounding that retreat (interest rates increasing, the war in Ukraine, massive inflation coming out of the pandemic, among other things).

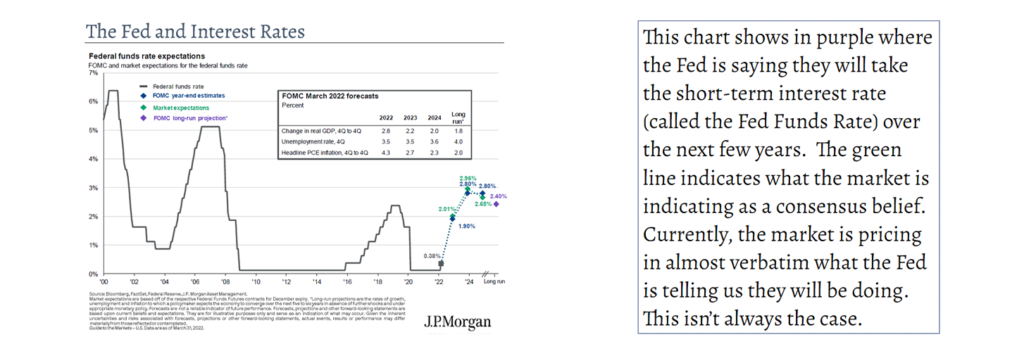

RISING INTEREST RATES: One of the many notable issues driving this tumultuous market.

Bonds play a unique role in portfolios and it’s worth refreshing our memories of how they act in a rising rate economy:

- Concerns about inflation are driving bond yields higher. The market is pricing in about 7 interest rate hikes in 2022.

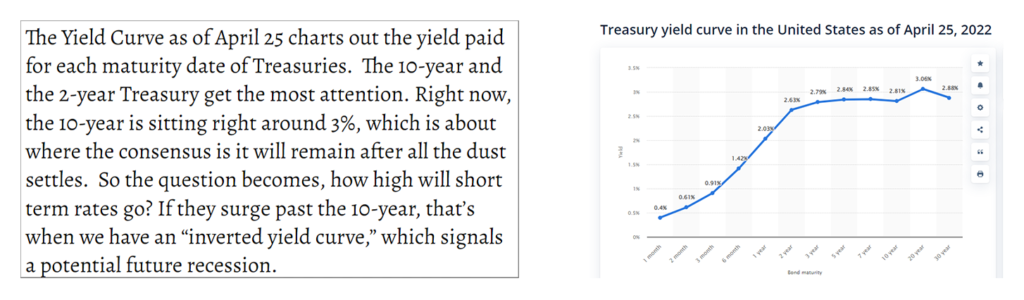

- The 10 year Treasury bond has moved from about 1.5% to about 3%. The rule of thumb is that for every 1% raise in rates, the value of your bond will decrease equal to the maturity in the interim. So, if you have a 10-year bond and interest rates go up 1 %, then your bond value will likely decrease about 10% in the interim.

- The good news is there is consensus that the 10-year Treasury bond is nearly to the terminal value where it is thought it will no longer increase. This would mean that the majority of the beating the longer term bonds have taken could be almost in the rearview mirror.

- Remember, a bond has a face value that MUST be paid back if you hold it to maturity. It’s only if you sell before then that you are beholden to the market prices. That means that anything in between is just “noise” if you are holding the bonds to maturity. Market value, hence performance, doesn’t matter.

- While bonds have not provided the ‘performance hedge’ to the stock market that we normally anticipate in flat interest rate cycles, actual value is not necessarily lost. Performance may take a hit for a time but value will remain if you hold the bond until maturity

- Strategies to implement include holding quality bonds, perhaps some short-term target date ETFs that can be held to maturity, and then contemplating moving from short duration to longer duration once the 10 year Treasury approaches what is thought to be the terminal rate.

There has been considerable attention paid to the Fed raising interest rates. While it is necessary to get back to healthy short-term rates, it is not easy to swallow the painful process of getting there. However, the silver lining is that portfolios will be in a much better place once there. Right now is the time to assess what you want to own in 6 to 12 months for the next bull market run.

INFLATION AND EARNINGS: The other issues adding to the chaos. Will there be a recession?

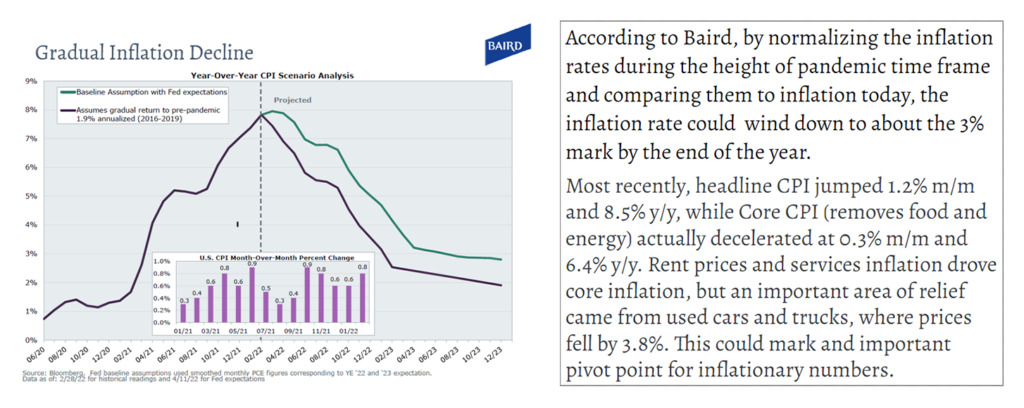

Inflation

Inflation has been increasingly in the news as the year-over-year numbers have been unprecedented. Recall that comparing today to a year ago is like comparing sales revenue of a restaurant today to that of the height of a pandemic when they were nil. Of course the revenue numbers in comparison are massive by percentage increase!

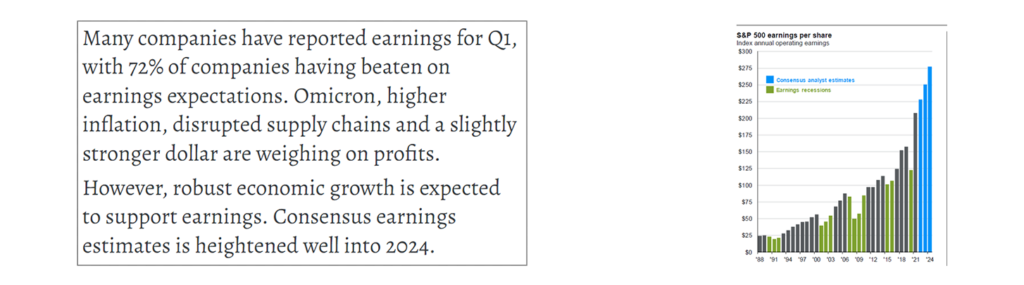

Earnings…

Recession…

We are going to hear a lot about the potential for a recession in the next 6-12 months. The Fed is in a very hard spot as they need to cool inflation, but if they raise rates too quickly it could actually stunt growth. If economic growth is stunted but inflation isn’t abated, we would be in the worst of worlds in “stagflation.” Currently, the market is pricing in much of the economic weakness, but it is not yet pricing in a potential recession. If companies start to pause their spending in fear of a recession, it could very well be self-fulfilling and create the very recession feared. It is likely we find ourselves in a recession by technical definition – but we may or may not feel it until we are through it.

What does it all mean?

We have relied on low interest rates for a decade to stimulate the economy through the Great Recession and then the pandemic. It is only healthy to move rates back to a point that removes the risk trade that has all boats rising with the tide. From here, selective stock picking of quality stocks will be key as the risk taken on by many companies may prove to become too burdensome. While painful to move from point A to point B, portfolios will be much healthier. Yields will be higher and provide a much safer income stream, too. In addition, investors will not have to take on so much equity risk to support their planning returns. Unfortunately, in the interim we will go through the withdrawal symptoms of removing the proverbial punchbowl – low rates.

What to do?

- Don’t try to time in or out of the markets; it’s an impossible strategy.

- Stay diversified and rebalance. All too often, fear leads to knee-jerk decisions that end up whipsawing your returns.

- Stay higher in credit quality for bonds and contemplate moving out in duration as the 10-year terminal yield is approached.

- The falling dollar will lend to investing internationally.

- Keep equities in quality, active managers. Look toward short-duration stocks (ones with more immediate cash flow), strong balance sheets and free cash flow.