by Merissa Perkins, CFP®

As you may have heard, Congress recently passed the SECURE 2.0 Act, which is designed to encourage increased retirement savings. There are several important changes included in the Act that anyone saving for retirement should be aware of. This act contains MANY new provisions; we dive into a few you need to know about below:

STARTING IN 2023

Beginning this year, employees have the option to receive employer-matching contributions and employer nonelective contributions (employer contributions made regardless of whether employees make their own contributions) on a Roth basis. However, this does not apply to profit-sharing contributions.

What you need to know: Select employer contributions will be included in employee gross income, resulting in a current tax burden. However, it is not clear how vesting in employer contributions will be impacted, as the intent is to make these contributions nonforfeitable.

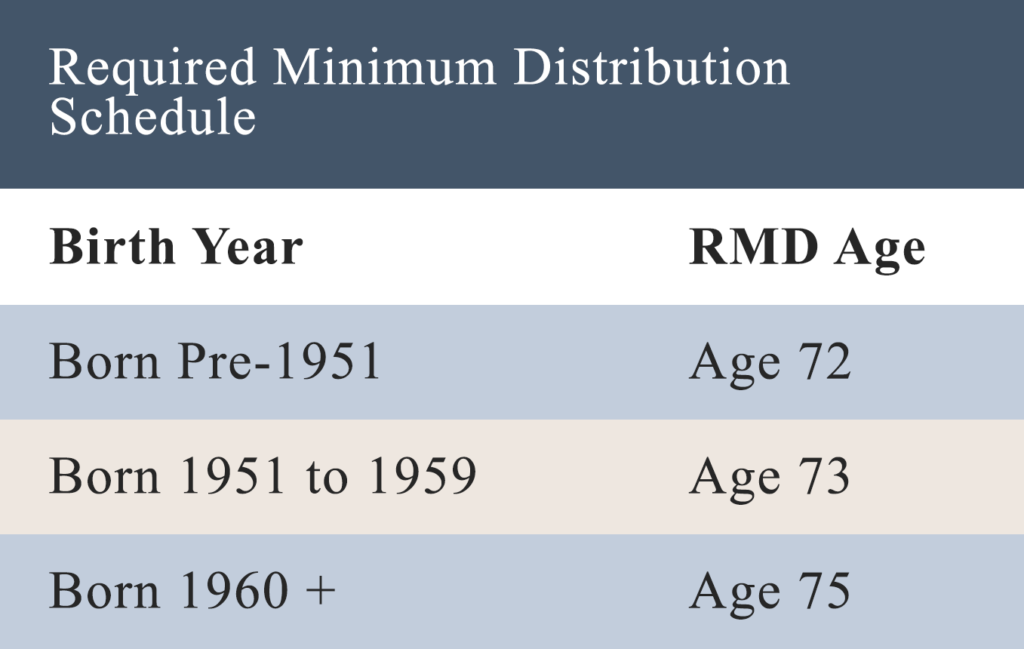

If you are turning age 72 this year, you now can wait another year to start your required minimum distributions (RMDs). The new beginning age for mandatory distributions from retirement accounts is 73, which applies to birth years 1951-1959.

Ten years from now, in 2033, the RMD age will be pushed out again to age 75, applying to birth years 1960 and later. It’s important to note that the RMD age change does not impact qualified charitable distribution (QCD) eligibility.

What you need to know: For the years 2023 and 2033, there will be no first-time RMDs. For those who can afford to wait on retirement account income, the extra years prior to RMDs can be used for tax-planning purposes, such as Roth IRA conversions, leveraging possible lower tax brackets, QCDs, etc.

STARTING IN 2024

Regarding Roth IRA income limits, for individuals who earn more than $145,000 in wages, the age 50+ catch-up contributions to a qualified retirement plan – 401(k), 403(b) and governmental 457(b) – must be made to a Roth account. If you are self-employed, your catch-up contributions may not be impacted by this change, as the rule is based on wages.

What you need to know: This update to the Act increases the amount of wages subject to taxes today as a cost of increasing Roth savings versus pre-tax savings. Employer plans must have a Roth option to accommodate high-wage earners that are eligible to make catch-up contributions, or no one is allowed to make catch-up contributions regardless of their wages.

Also as a result of the Act, assets from a 529 plan can be directly transferred (rolled over) to the beneficiary’s Roth IRA tax and penalty free.

What you need to know: This change reduces concerns of overfunding 529 plans and may be considered a “loophole” for funding Roth IRAs, which was likely not intended.

- Beneficiaries must have earned wages, but Roth IRA income limits do NOT apply.

- Rollovers are subject to the same contribution limits as a Roth IRA (2023: $6,500 and an additional $1,000 for the age 50 catch-up). Maximum lifetime rollover (transfer to beneficiary) is $35,000, not indexed for inflation (per beneficiary).

- A 529 plan must have been maintained for 15 years or longer. Any contributions to the 529 plan within the previous 5 years (and the earnings on those contributions) are ineligible to be moved into a Roth IRA. The expectation is that the change in beneficiary will not reset the 15-year clock, but it is not clear in the legislation and caution is urged to not use 529 plans to solely fund Roth IRAs.

IMPACT TO INHERITED IRAS

As introduced in the SECURE Act 1.0, non-spousal IRA beneficiaries (generally referred to as “designated beneficiaries”) can no longer “stretch” RMDs, but are instead subject to a modified 10-year payout. This Act is currently being reinterpreted by the IRS, potentially resulting in more stringent withdrawal mandates for traditional IRAs. Details surrounding the Act, along with revised guidance from the IRS, are as follows:

- Non-spousal beneficiaries of traditional IRAs (those who inherited accounts from decedents passing on or after 1/1/2020) are to fully deplete their account(s) within 10 years. However, the original guidance from the IRS did not indicate that RMDs were to be required during that 10-year period.

- New guidance issued by the IRS in the fall of 2022 indicates that RMDs may in fact be applicable during the 10-year withdrawal period (challenging previously understood guidelines). However, no official rules have been published around how these RMDs should be calculated.

WHAT IS NOT INCLUDED IN THE SECURE 2.0 ACT

The SECURE 2.0 Act does NOT include extensions for expired or soon-to-be expiring tax preference provisions, nor does it suspend the scheduled changes for the Tax Cuts and Jobs Act. In addition, it does not implement limits on Roth IRA backdoor contributions, Roth conversions, etc. Finally, the Act does not provide clarity on how to implement SECURE Act 1.0 related to non-eligible designated beneficiaries.

The CAISSA team is here to talk through the potential impact of the SECURE 2.0 Act on your financial situation. Please reach out if you’d like to discuss.

Read a more in-depth analysis of the SECURE 2.0 Act here.