Staying Calm During Market Ups and Downs

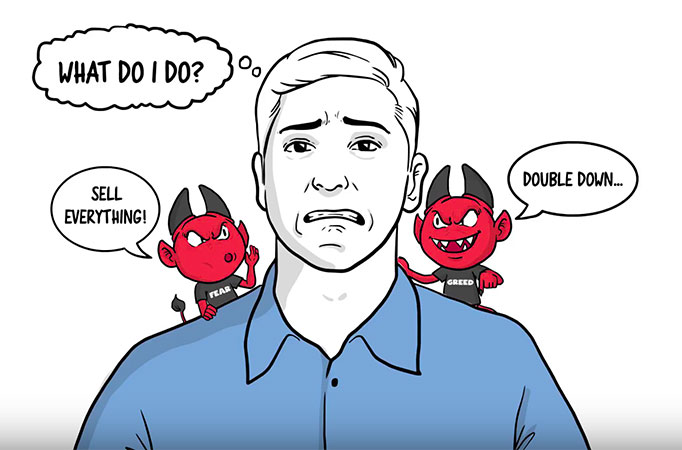

When we react emotionally to the market, the emotions that typically rule our decision-making are fear and greed.

Staying Calm During Market Ups and Downs

When we react emotionally to the market, the emotions that typically rule our decision-making are fear and greed.

Over the last month, we have seen a very nice bounce in the market. But we also anticipate that markets will get turbulent again in the coming months. When the stock market swings, it is easy to get caught up in the day-to-day fluctuations of our investments. We can see these changes in real time with a few clicks on a website, or receive instant notifications via a portfolio managing app.

When we react emotionally to these ups and downs, the emotions that typically rule our decision-making are fear and greed. Fear motivates investors to sell when the going gets tough, and they miss out on long-term gains. Greed can cause investors to make risky, impulsive choices when the market is on the rise to earn a quick profit.

We can’t control the markets, but we can control our response to them. This is why our CAISSA team builds strategic, long-term plans when the market is good, so you’re not questioning your approach during a downturn. We use these stress-tested plans to help reduce anxiety and remove the temptation to make dramatic changes to your investments fueled by emotions.

Rather than swinging between conservative and aggressive financial approaches in response to the economy, we plan for the good and the bad. We do this by strategically building three Tranches of Income for the short term, mid term and long term. (For more on what we’re doing for our clients right now, read our client memo.)

We are likely going to continue seeing volatile swings in the stock market this year. Instead of being consumed with the daily fluctuations, remember to focus on the big picture. A strong financial planning foundation and a long-term mindset can weather any storm.