The Debt Ceiling and Navigating Portfolios

Recent activity in Washington has many investors asking questions about whether they should adjust portfolios in the wake of the congressional negotiations regarding the National Debt Ceiling. The CAISSA Investment Committee summarizes what an investor should consider regarding this topic.

The Issue:

- The U.S. government could exhaust its ability to borrow money as early as June 1, 2023, without a debt ceiling extension (however the exact timing is largely unknown and called the “X Date”).

- Divided partisan control of Congress raises questions about the timely passage of legislation to raise the debt ceiling. As deadlines approach to meet spending obligations, a sharpening political divide may raise concerns for capital markets.

- As indicated by Schwab Analysts, the most likely scenario would be a “Technical default”. A technical default is defined as an extended period of non-payment of interest and principal on the debt. It happens from time to time in emerging-market countries, but not in major developed countries with the ability to pay. An “actual default” is more likely when a government does not have the ability to pay, which often results in a restructuring of the debt. In the U.S., the issue is an unwillingness to pay and assuming an agreement were eventually reached, investors would receive their interest and principal payments—likely with extra accrued interest

What Investors Should Know:

- Investors are faced with trying to predict whether lawmakers make a last-minute deal to raise the country’s borrowing limit, as they have done in the past, or if the Nation will enter a “technical default” and temporarily fail to satisfy its obligations. The latter would have negative consequences that are difficult for investors to comprehend, much less reflect in asset prices.

- A similar impasse occurred in 2011 as Congress squared off over the debt ceiling issue. At that time, capital markets proved to be very volatile as the deadline for legislation approached. Two days before the date when the Treasury Department estimated that it would run out of funds using extraordinary measures, Congress voted to raise the debt ceiling.

- While many portfolio managers and strategists do not anticipate that this year’s debt-limit debate in Congress will mirror what happened in 2011, they quickly point out that the duration of the discussions could have volatile consequences in the market.

What’s Next:

- Should the negotiations drag on, slowing economic growth and interest rate pressures could compound the volatility in the interim.

- Consensus is Washington will raise the debt limit sometime this summer, prior to the “X Date” and avoid a technical default. The most likely scenario is budget-cutting demands are pursued as long as they can until the debt ceiling deadline is imminent. Historically, despite past periods where debt ceiling deadlines were threatened, an extension has always been approved before the government defaulted.

- While there is always the potential for the unthinkable to happen, this likely represents more of a short-term volatility issue, which we lean on our tactical portfolio managers to work through. We do not believe that this presents a need for a material change to our long-term strategic asset allocation strategy.

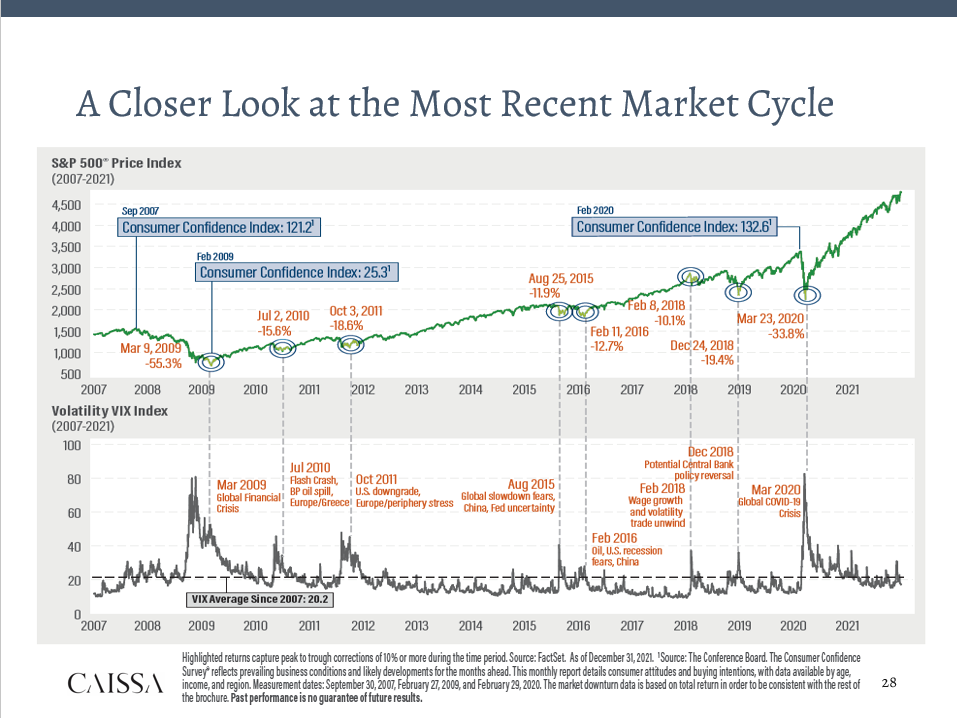

This short-term volatility is a good reminder to continue to stay disciplined and focused on our long-term investment strategy. Politically driven events have historically been short lived and have made little impact on the long-term returns of the market (as shown in the graphic below)