The stock market is near an all-time high. What is your greatest risk?

Complacency – your greatest risk as the stock market nears an all-time high

By Kelly Olson Pedersen, CFP®, CDFA

With the stock markets hovering at all-time highs, one of the biggest risks facing investors can be summed up in one word: complacency.

You might be wondering why. Why not let the good times roll? What’s wrong with letting our investments work for us while we sit back and enjoy the frothy returns?

It’s simple. The good times will not last forever. They never do of course, and the smart investor is always prepared for “what’s next.”

The reality is the next downturn will come soon enough. No one knows exactly when that will be, but it’s inevitable. Now is the time to prepare for that inevitability and focus on ensuring your financial plan and investing strategy makes the most of the current environment … and the one to come. As the old saying goes, “Make hay while the sun shines.”

As your partners on your financial journey, that’s what we are here for – to help you navigate the markets in good times and bad. Below are four strategies to explore now:

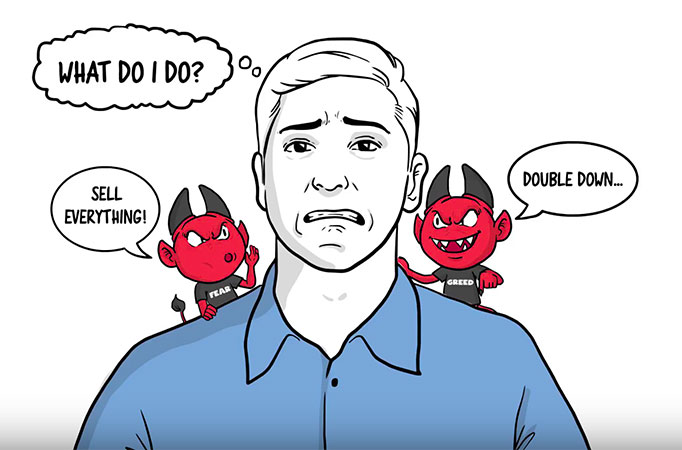

1. Harness the emotions of fear and greed

1. Harness the emotions of fear and greed

Warren Buffett famously has said, “Be fearful when others are greedy and greedy when others are fearful.” In other words, be contrarian. When everyone else is clambering to pour more money into the markets (GameStop comes to mind), that is likely a signal that it’s time to shift, or at least revisit, your strategy.

You want to be “ahead of the curve.” That means seeing around corners and pivoting before you get to the bend in the road. When the markets are at their high points, that is the time to rebalance your portfolio. Consider taking some “profit off the table” and redeploying those assets into investments that are under-valued. We can help with that.

Particularly when the markets are going gangbusters, it is important to remind yourself of how awful a prolonged downturn can feel, especially when you are ill-prepared for it. Most of us have lived through that experience. Don’t relive the angst of it all. Disciplined investing can help you manage the emotions of fear and greed and use them to your advantage now and in the future.

2. Take time to revisit your financial plan

Financial plans are not set in stone. Yes, let them do their work, but also understand that financial plans require regular revisiting and refreshing, especially at peaks and lows in the market. The key is to not let your emotions dictate how your financial plan is executed. Rather, it is through careful and thoughtful deliberation that financial plans release their full power.

By refreshing your financial plan now, you will be best positioned to weather the inevitable volatility to come. The key is to be proactive, not reactive. Have a clear vision and strategy for your action plan when the next downturn comes. Perhaps that involves tax-loss harvesting, or rolling over a traditional IRA into a Roth, or a plan for buying distressed assets “on the dips.” The point is you should never “just ride it out.” You should have a disciplined strategy at the ready for every eventuality.

3. Know your buy and sell thresholds

Particularly if you have concentrated stock positions, it’s important to clearly define your buy and sell thresholds, which involves both a ceiling price and a floor price. That is to say, be aware of what price target you are going to sell at. Without that foresight, you’ll likely succumb to emotions when that stock price begins to fluctuate.

4. Never invest more than you’re willing to lose

4. Never invest more than you’re willing to lose

Finally, never invest more than you are willing to lose. Period. That means knowing what your lifestyle requires in terms of ongoing expenses, and also how long you expect that lifestyle to last.

The truth is many people overestimate their tolerance for risk. Ask yourself how you’d feel if the market dropped 20 percent in the next year. If you can’t stomach that uncertainty, then you may want to adjust your portfolio to better align with your risk tolerance. In short, be honest with yourself about what you can handle emotionally.

With the trauma of 2020 still fresh in our minds, particularly how quickly the world can change and markets sour, have enough assets in short-term investments to sustain your lifestyle needs. Almost every recession we’ve endured has bottomed out and recovered within four years, so having that much in liquid cash will allow you to weather any looming downturns.

In summary, the current market highs are not a license to fall into complacency. Rather, it’s a time to take action and ensure you are prepared for whatever the future may bring.